Exness Indonesia Online Trading Platform

Exness Indonesia is a leading online trading platform offering access to global financial markets since 2008. As a reliable forex broker, Exness provides Indonesian traders with advanced trading solutions featuring instant withdrawals processed within 1 minute for 95% of requests – an industry-leading standard that truly sets Exness apart from competitors.

$2.5+ trillion

monthly trading volume from traders worldwide

500,000+

active clients across global markets including Indonesia

24/7

multilingual support with dedicated Indonesian language assistance

About Exness ID

Exness began operations in 2008 and now serves thousands of Indonesian traders in the global financial markets. The company maintains over 500,000 active clients worldwide and processes more than $2.5 trillion in monthly trading volume. These numbers position Exness as a major competitor in the forex trading industry. The trusted broker delivers consistent performance through transparent policies and reliable trading execution.

Exness Indonesia provides Indonesian traders with essential trading tools and market education resources tailored to local needs. The broker focuses on practical features that matter to traders, including fast withdrawals and diverse trading options. Both new and experienced traders in Indonesia choose Exness for its stable platform and straightforward trading conditions.

Regulation and Legal Status in Indonesia

Exness operates under multiple international regulatory bodies, ensuring a secure trading environment. Exness (SC) Ltd is authorized by the Financial Services Authority (FSA) in Seychelles with license number SD025. Exness B.V. is regulated by the Central Bank of Curaçao and Sint Maarten (CBCS) with license number 0003LSI. These licenses enforce strict financial standards, offering trader protection through segregated accounts and negative balance protection.

Additionally, Exness is overseen by other reputable regulators:

- Financial Services Commission (FSC) in BVI and Mauritius

- Financial Sector Conduct Authority (FSCA) in South Africa

- Cyprus Securities and Exchange Commission (CySEC) in Cyprus

- Financial Conduct Authority (FCA) in the UK

- Capital Markets Authority (CMA) in Kenya

- Jordan Securities Commission (JSC) in Jordan

While Exness does not hold a local license in Indonesia, its international regulations ensure compliance and safety for Indonesian traders. Forex trading is legal in Indonesia, but traders should verify local laws for full compliance. Exness’s global oversight makes it a trusted choice.

Exness Trading Conditions

Exness offers Exness trading conditions that stand out in the forex market, providing competitive trading features for all trader levels. With low minimum deposits starting at $10, spreads from 0.0 pips, and leverage up to 1:2000, Exness ensures flexibility and cost efficiency. Instant deposits and withdrawals, paired with transparent pricing, make it a reliable choice for traders seeking value and performance without unnecessary complexity.

Exness Trading Accounts

Exness offers five Exness account types—Standard Cent, Standard, Raw Spread, Pro, and Zero—designed for varied trading needs. Below is a comparison of key parameters:

| Account Type | Min Deposit | Spread (EUR/USD) | Commission | Execution | Leverage |

| Standard Cent | $1 | From 0.3 pips | None | Market | Up to 1:2000 |

| Standard | $10 | From 0.3 pips | None | Market | Up to 1:2000 |

| Raw Spread | $200 | From 0.0 pips | $3.50 per side | Market | Up to 1:2000 |

| Pro | $200 | From 0.1 pips | None | Market | Up to 1:2000 |

| Zero | $200 | From 0.0 pips | From $0.2 per side | Market | Up to 1:2000 |

The Standard Cent account fits beginners testing strategies with a $1 entry and no commissions. The Standard account suits novices needing low costs. Raw Spread targets scalpers with tight spreads and a small fee. The Pro account supports experienced traders with instant execution. Zero serves professionals trading major pairs with zero spreads and fixed commissions.

Competitive Spreads Starting from 0.0 Pips

Exness provides low spreads, with Exness spreads starting at 0.0 pips on Raw Spread and Zero accounts. For EUR/USD, spreads average 0.0 pips, compared to the industry’s 0.6 pips. GBP/USD averages 0.1 pips on Pro accounts, below the typical 1.0 pip. Spreads differ by instrument:

- Metals (XAU/USD): From 0.3 pips

- Indices (US30): From 1.5 pips

- Cryptocurrencies (BTC/USD): From 20 pips

Leverage up to 1:2000

Exness offers Exness leverage up to 1:2000 leverage, providing flexibility across instruments. Forex leverage reaches 1:2000 for currency pairs, while other assets have specific limits:

| Instrument | Max Leverage |

| Forex | 1:2000 |

| Metals | 1:2000 |

| Indices | 1:400 |

| Cryptocurrencies | 1:200 |

Warning: High leverage increases profits but also heightens loss risks. Traders must control exposure to safeguard their funds.

Instant Deposits and Withdrawals

Exness stands out with fast deposits and Exness instant withdrawals, processing 95% of withdrawals instantly. Most transactions finish within minutes, though some methods may take up to 24 hours. This ensures quick fund access. Available withdrawal processing options include:

- Bank transfers

- Credit/debit cards

- E-wallets (Skrill, Neteller)

- Local payment methods

Exness Indonesia Trading Platforms

Exness provides multiple trading platforms for Indonesian traders. The company offers complete forex platforms across desktop, web browsers, and mobile devices. All Exness trading platforms synchronize trading accounts automatically. Traders can switch between devices without losing positions or account information. The trading software includes industry-standard options and proprietary solutions for flexible market access.

MetaTrader 4 (MT4)

Exness MT4 remains popular among Indonesian traders for its reliability and comprehensive tools. The platform supports all trading styles with a stable connection to Exness servers. MetaTrader 4 combines powerful analysis capabilities with simple execution features for effective trading.

Key MT4 features include:

- Advanced charting with 30 built-in indicators and 24 analytical objects

- Support for Expert Advisors (EAs) and automated trading strategies

- Option to create and use custom indicators for personalized analysis

- One-click trading directly from charts for fast execution

- Multiple timeframes from 1-minute to monthly charts for detailed market analysis

MetaTrader 5 (MT5)

Exness MT5 represents the next generation of trading technology with enhancements over MT4. Indonesian traders gain access to more markets and improved functionality. The platform delivers faster processing and advanced market depth information for informed trading decisions.

Key advantages of MetaTrader 5:

- Access to more trading instruments including stocks and futures

- Economic calendar built directly into the platform

- 21 timeframes compared to 9 in MT4 for more detailed analysis

- Improved backtesting capabilities for strategy verification

- Advanced Market Depth (DOM) trading for precise order placement

This advanced trading platform supports both hedging and netting accounting systems for flexible position management.

Exness Web Terminal

The Exness Web Terminal allows trading directly from web browsers without downloading software. This platform works on any computer with internet access. Traders can log in from any location and access their accounts instantly, making it ideal for trading on-the-go or from restricted computers.

Key web platform features:

- Compatible with all major browsers (Chrome, Firefox, Safari, Edge)

- Full charting capabilities with multiple technical indicators

- All order types supported including pending orders

- Real-time account synchronization with desktop and mobile versions

Exness Mobile Applications

Exness mobile apps deliver full trading functionality on smartphones and tablets. The applications work on both Android and iOS devices with optimized interfaces for smaller screens. Traders can download the Exness APK directly from the Google Play Store or Apple App Store for immediate installation.

Essential mobile trading features:

- Real-time quotes and interactive charts with multiple timeframes

- Complete order management system for opening and closing positions

- Push notifications for price alerts and account updates

- Built-in market analysis tools and economic calendar

- Biometric authentication for secure account access

The trading app connects to the same Exness servers as desktop platforms, ensuring consistent execution across all devices.

Trading Instruments on Exness

Exness offers more than 200 trading instruments across multiple asset classes. Indonesian traders can access a complete range of forex CFDs, commodities, indices, and stocks through a single account. All Exness trading instruments feature competitive conditions with minimal slippage and fast execution. The platform supports both short and long positions on all assets, allowing traders to find opportunities in any market direction.

Forex (Majors, Minors, and Exotics)

Exness offers extensive forex trading Exness options with numerous currency pairs. Traders choose from majors, minors, and exotics, including Asian-relevant pairs like USD/IDR. Available categories include:

- Majors: EUR/USD, GBP/USD, USD/JPY

- Minors: EUR/GBP, AUD/NZD, CAD/CHF

- Exotics: USD/IDR, USD/THB, USD/ZAR

Metals and Energies

Exness enables trading in metal CFDs and energies like gold, silver, and oil. Gold trading (XAU/USD) features spreads from 0.3 pips, while oil trading Exness (UKOIL, USOIL) offers leverage up to 1:2000. Below are trading details:

| Instrument | Trading Hours (UTC) | Spread (Pips) |

| XAU/USD (Gold) | 22:05 Sun – 21:55 Fri | From 0.3 |

| XAG/USD (Silver) | 22:05 Sun – 21:55 Fri | From 0.4 |

| USOIL (Oil) | 00:05 Mon – 21:55 Fri | From 2.0 |

These conditions suit commodity-focused traders.

Indices and Stocks

Exness offers index trading on major global benchmarks including US, European, and Asian markets. Indonesian traders can trade indices like US500 (S&P 500), US30 (Dow Jones), and JPN225 (Nikkei) with competitive conditions.

All Exness stocks trade with zero commission on Standard accounts. Index instruments operate on extended hours compared to their underlying exchanges, giving traders more opportunities throughout the day.

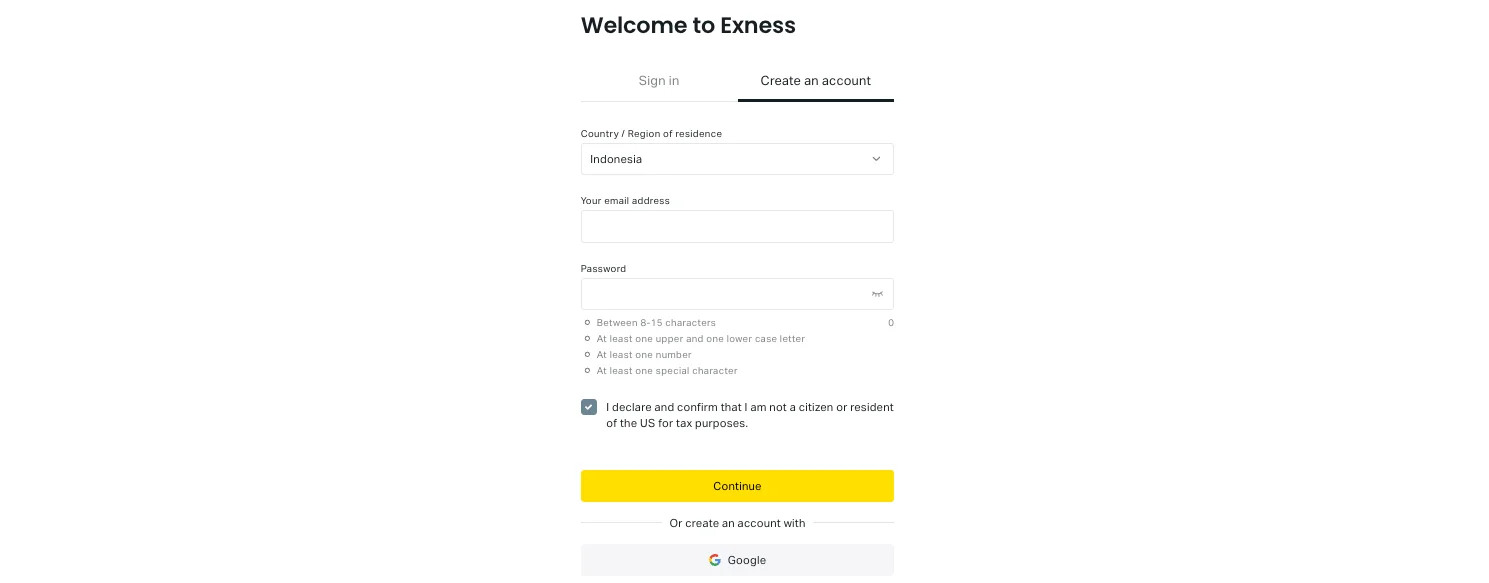

How to Register an Exness Indonesia Account

The process to open Exness account takes less than 5 minutes. New traders complete a simple form with basic personal information. The Exness registration system works on all devices including mobile phones and tablets. Indonesian traders receive immediate access to their Personal Area after completing the form. This allows users to start trading quickly without unnecessary delays or complicated procedures.

Exness Registration

Follow these steps to register Exness account and begin trading:

- Visit the official Exness website and click the “Register” button in the top corner.

- Enter your email address and create a secure password (8+ characters with numbers and letters).

- Provide your full name exactly as it appears on your identification documents.

- Enter your mobile phone number with the correct country code (+62 for Indonesia).

- Select IDR (Indonesian Rupiah) as your account currency.

- Choose your preferred trading platform (MT4, MT5) and account type.

- Accept the terms and conditions after reading them.

The entire Exness signup process takes approximately 3-5 minutes. New traders can create trading account instantly and access the Personal Area immediately after registration.

Exness Account Verification

Exness verification is a key step for security and full account access. The account verification or KYC process requires the following:

- Proof of Identity (POI): Submit a clear photo of your KTP, SIM, passport, or driver’s license.

- Proof of Residence (POR): Provide a utility bill, bank statement, or tenancy agreement (issued within the last 6 months).

The process typically takes up to 24 hours, though delays may occur during busy periods. After approval, you can deposit funds, trade, and withdraw without limitations.

Exness Client Support in Indonesia

Exness support Indonesia operates 24/7 through multiple channels. The team includes native Bahasa Indonesia speakers who understand local trading needs. Indonesian traders receive prompt assistance with account issues, trading questions, or technical problems at any time.

Trader support options include:

- Live Chat – Available directly on the Exness website and within the Personal Area, with Indonesian language support and typical response times under 1 minute

- Email Support – Send detailed queries to [email protected] with 24-hour response guarantee

- Phone Support – Indonesian traders can call dedicated regional numbers during business hours

- Help Center – Comprehensive knowledge base with articles and tutorials in Indonesian language

- Social Media – Active support through Facebook and Telegram channels popular with Indonesian traders

All customer service communications maintain strict confidentiality and security protocols. Support staff cannot make trades or withdraw funds from client accounts under any circumstances.

Indonesian Traders’ Reviews about Exness

Exness reviews Indonesia generally highlight fast withdrawals and platform reliability as key advantages. Indonesian traders appreciate the broker’s continuous operation during volatile market conditions. Most trader testimonials mention prompt fund processing and stable trade execution.

“I have traded with three brokers before finding Exness. Their withdrawal system processed my funds in less than 5 minutes to my Indonesian bank account. This level of efficiency makes a significant difference for active traders.” – Budi S., Jakarta trader since 2019

“The MT5 platform never crashes during major news events, unlike other brokers I used before. However, I would appreciate more Indonesian market analysis and educational webinars in our time zone.” – Anita R., forex trader from Surabaya

Areas for improvement in Exness feedback include requests for more localized educational content and additional Indonesian payment methods. Overall satisfaction remains high with most traders citing low spreads and withdrawal speed as deciding factors for choosing Exness.

Local Payment Methods

| Payment Method | Processing Time | Minimum Deposit | Withdrawal Time |

| Bank Transfers | |||

| Bank BCA | 1-2 hours | 200,000 IDR | 1-24 hours |

| Bank Mandiri | 1-2 hours | 200,000 IDR | 1-24 hours |

| Bank BNI | 1-2 hours | 200,000 IDR | 1-24 hours |

| Bank BRI | 1-2 hours | 200,000 IDR | 1-24 hours |

| E-Wallets | |||

| GoPay | Instant | 200,000 IDR | Instant |

| OVO | Instant | 200,000 IDR | Instant |

| DANA | Instant | 200,000 IDR | Instant |

| LinkAja | Instant | 200,000 IDR | Instant |

All deposit options process without fees from Exness, though payment providers may apply their own charges. Local bank transfers support transactions in Indonesian Rupiah (IDR), eliminating currency conversion costs for local traders.

6 Asset Classes – 16 Trading Platforms – Over 1000 Instruments.

Trade Forex, Individual Stocks, Commodities, Precious Metals, Energies and Equity Indices at Exness.

FAQ

Is Exness legally allowed to operate in Indonesia?

Yes, Exness operates legally in Indonesia. The broker functions under international regulations including licenses from the Financial Services Authority (FSA) of Seychelles and the Financial Sector Conduct Authority (FSCA) of South Africa. While not directly regulated by Indonesian authorities, Exness services remain accessible to Indonesian residents through its global regulatory framework.

What’s the minimum deposit I need to start trading with Exness?

The minimum deposit on Exness is 200,000 IDR (approximately $10) for Standard accounts. This low entry point makes the platform accessible for new traders. Pro accounts require a higher minimum deposit of 4,000,000 IDR (approximately $200). All deposits process instantly and Exness charges no fees for funding accounts through any method.

How fast can I withdraw my funds from Exness?

Exness processes 95% of withdrawals instantly (under 1 minute). After processing, local bank transfers to Indonesian banks typically complete within 24 hours. E-wallet withdrawals (GoPay, OVO, DANA) typically reach accounts instantly after approval. There are no withdrawal fees charged by Exness, though payment providers may apply their own charges.

Which trading platforms can I use with Exness?

Exness offers four main trading platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), Exness Web Terminal, and mobile applications. All platforms synchronize automatically across devices. MT4 and MT5 provide desktop downloads for Windows and Mac. The Web Terminal works in any browser without downloads. Mobile apps are available for both Android and iOS devices.

What payment methods can I use to deposit and withdraw in Indonesia?

Indonesian traders can use local bank transfers (BCA, Mandiri, BNI, BRI), e-wallets (GoPay, OVO, DANA, LinkAja), and international methods (Visa/Mastercard, cryptocurrency). All local payment options support Indonesian Rupiah (IDR) currency. Bank transfers typically process within 1-2 hours, while e-wallet transactions complete instantly for both deposits and withdrawals.

What different types of trading accounts does Exness offer?

Exness provides several account types: Standard (fixed spreads, no commission), Raw Spread (variable spreads with commission), Pro (institutional-grade execution), and Zero (zero spreads with higher commission). Each account type supports different trading styles and experience levels. All accounts offer leverage options up to 1:2000 and instant deposit/withdrawal features.

Can I get customer support in Indonesian language?

Yes, Exness provides full customer support in Bahasa Indonesia. Indonesian traders can access native language assistance through live chat, email, and phone support. The support team operates 24/7 and understands local trading concerns. The Exness website, educational materials, and Personal Area interface are all available in Indonesian language.

What can I trade on Exness – just forex or other instruments too?

Exness offers over 200 trading instruments beyond forex. While currency pairs form the core offering (120+ pairs), traders can also access metals (gold, silver), energies (oil, natural gas), stock indices (US500, US30, JPN225), and individual stock CFDs from major global companies. All instruments trade through the same account with no additional setup required.

How does Exness keep my money safe?

Exness protects client funds through segregated accounts at tier-1 banks, completely separate from company operational funds. The broker implements negative balance protection, preventing traders from losing more than their deposits. Advanced encryption secures all transactions and personal data. Regular independent audits verify financial compliance with international standards to ensure fund security.

How do I open an Exness account if I’m in Indonesia?

To open an account from Indonesia, visit the Exness website and click “Open Account.” Enter your email, create a password, and provide basic personal information. Select IDR as your account currency and choose your preferred platform and account type. The process takes less than 5 minutes. After registration, complete verification by uploading your ID and proof of address documents.

Learn more about Exness

Exness Raw vs Zero Spread Account Comparison

Exness Rebate Program: Earning and Calculation Methods

Exness Referral Commission Program

Exness Server Time and Trading Hours

6 Asset Classes – 16 Trading Platforms – Over 1000 Instruments.