Maintaining Appropriate Margin Levels on Exness

Follow this essential guide on 10 must-have tips on How to Maintain Margin Level on Exness to Reduce Risk. Good margin level management allows you to trade with higher confidence while safeguarding your account against sudden market movements. In this guide, we’ll discuss what margin levels are, how to calculate them, and how to keep them in check.

What is Margin Level in Trading on Exness?

The Margin level on Exness indicates the ratio of your account equity to the margin used for open positions. It shows whether you have sufficient balance to maintain your trades. High margin level means you’re safe, low margin level means you’re at risk of margin call.

For example, if you have $10,000 in equity and use $2,000 for margin, your margin level would be 500%. A high margin level means you have enough to support your positions. But if the margin level falls too low, Exness may close some of your trades to prevent further loss.

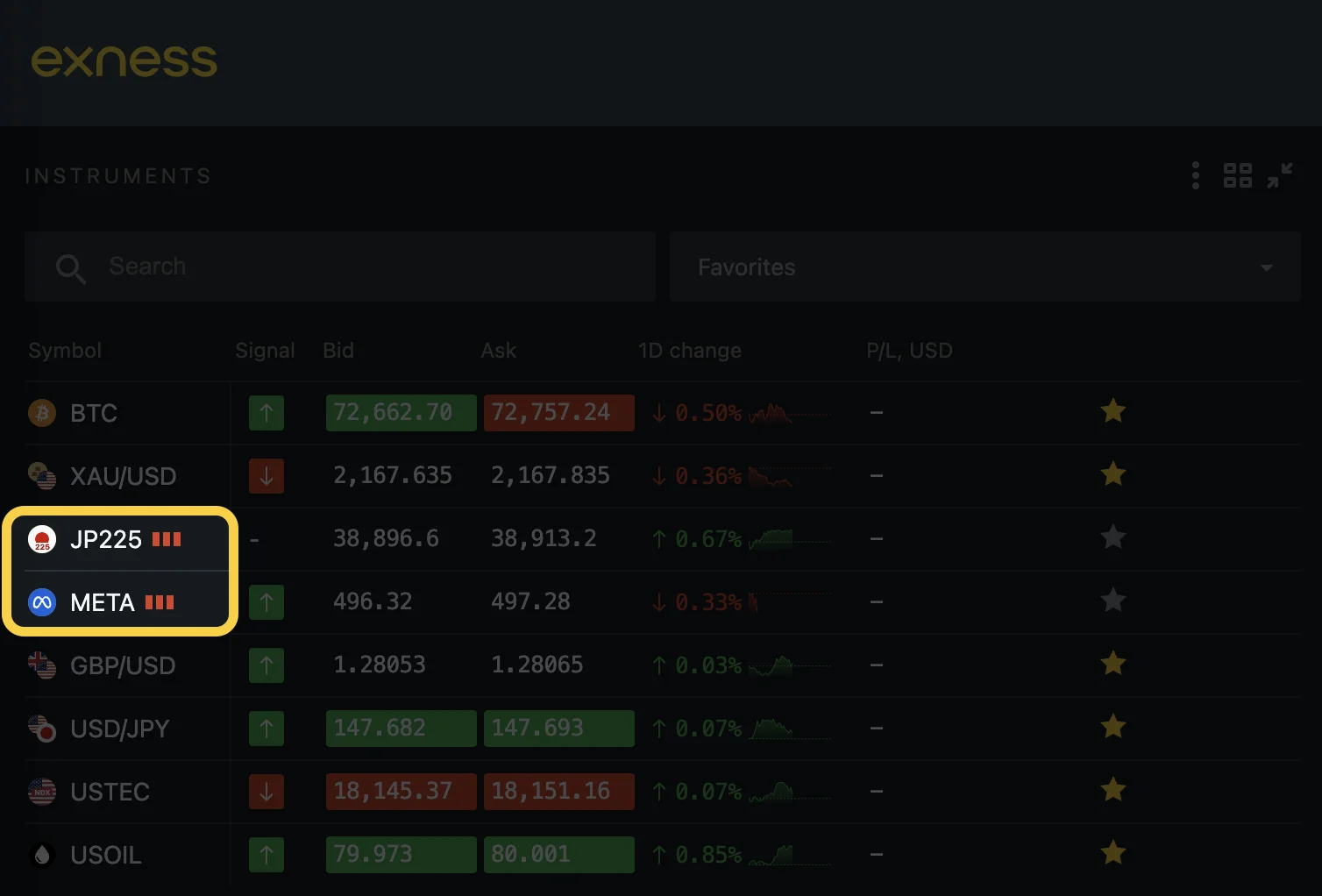

Exness Margin Requirements for Different Assets

The margin requirement on Exness depends on the asset that you trade. Certain assets say require less margin, whereas other are more volatile and need more. The site gives mention of these prerequisites so you can ensure that for having enough money in your account.

Here is a simple table of margin requirements for different assets:

| Asset Type | Margin Requirement (%) |

| Forex (Major pairs) | 0.10% – 1% |

| Forex (Minor pairs) | 0.25% – 2% |

| Commodities (Gold) | 1% – 5% |

| Stocks | 5% – 10% |

| Cryptocurrency | 2% – 10% |

| Indices | 1% – 3% |

For example, if you are trading EUR/USD (a major forex pair), the margin requirement might be as low as 0.10%. But if you trade something like gold, the margin requirement could be as high as 5%. Always check the margin requirement for the asset you want to trade, as it can change depending on market conditions.

Calculating Your Current Margin Level

In order to find out your margin level on Exness, you should know two things: your used margin and your equity. To illustrate how this works, let’s go through a real example.

Steps to calculate margin level:

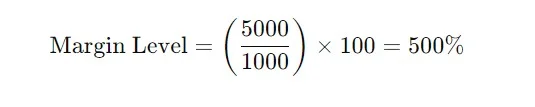

- Equity: This is the total value in your account, including any unrealized profits or losses. For this example, let’s say your equity is $5,000.

- Used Margin: This is the amount of money you’ve set aside to maintain your open positions. Let’s assume your used margin is $1,000.

Now, let’s calculate the margin level:

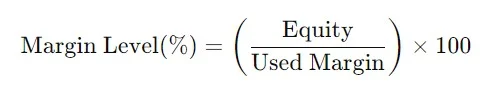

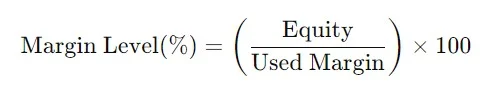

The formula is:

For our example:

Your margin level is 500%, which means you have more than enough equity to support your trades. This is a safe margin level.

What if your equity changes?

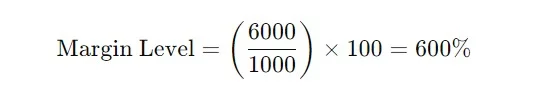

If your equity goes up, your margin level improves. Let’s say your equity increases to $6,000 while your used margin stays at $1,000:

Now your margin level is 600%, which is even better.

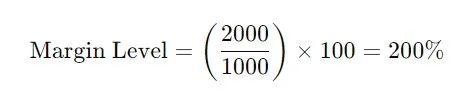

But if your equity drops, your margin level will decrease. For example, if your equity falls to $2,000:

In this case, your margin level is 200%, which means you are getting closer to the risk zone. If your margin level gets too low (usually below 100%), you could get a margin call, and Exness might close some of your positions to prevent further losses.

So, it’s important to keep your margin level as high as possible to avoid risks.

Actions to Take When Approaching Margin Calls

If your margin level gets too low, you could face a margin call, meaning you don’t have enough funds to keep your trades open. Exness will warn you when this happens, and it’s important to act quickly. Here are a few things you can do:

- Add More Funds. If your margin level is low, adding more money to your account is the easiest way to avoid a margin call. This will increase your equity and give you more room for your trades.

- Close Some Trades. If you don’t want to add more funds, you can close some of your open trades. This will free up some margin and raise your margin level. Focus on closing the trades that are losing or that you don’t need.

- Reduce Your Position Sizes. You can also reduce the size of your open positions. Smaller positions use less margin, which can help improve your margin level without having to close your trades completely.

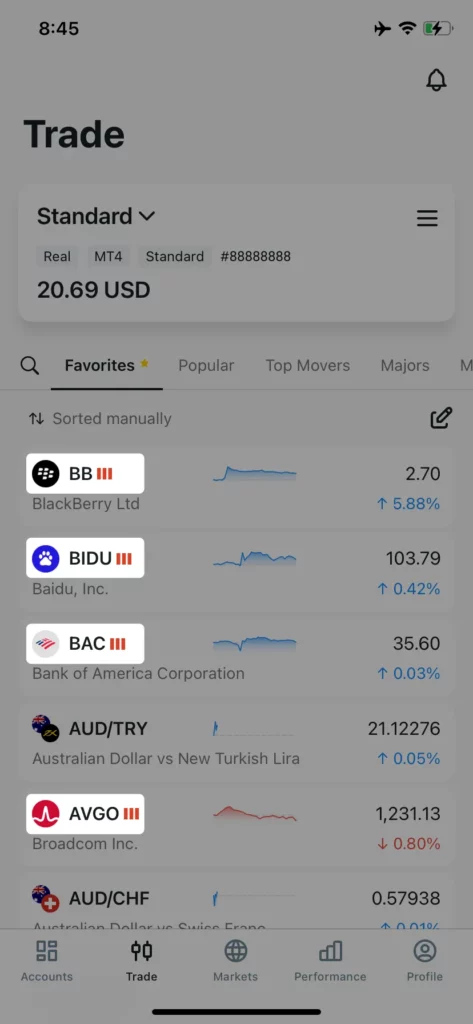

- Monitor Your Margin Regularly. Keep an eye on your margin level. Exness gives you real-time updates, so you can see when it’s getting low. By checking it often, you can take action before things get too risky.

- Use Stop-Loss Orders. A stop-loss order closes a trade automatically if the price goes against you. This can provide more control over your losses, preserve your equity, and protect yourself to a greater extent at your margin level.

Margin Management Strategies to Minimize Risks

1. Be Careful with Leverage

Leverage can increase both your profits and your losses. Using too much leverage can quickly lower your margin level. It’s best to use low leverage, especially if you’re new to trading, to minimize the risk.

2. Diversify Your Trades

Do not risk all of your capital on one asset or one trade. If you do more than one market trading (forex, stocks, commodities) you diversify your trades therefore you decrease your risk. This protects your margins in a way that even if one trade goes into a loss the others could end up being profitable.

3. Risk Only a Small Percentage of Your Account

A good rule is to risk no more than 1-2% of your total account balance on each trade. This way, even if a few trades don’t go your way, your account won’t be severely affected.

4. Set Profit and Loss Limits

Before entering a trade, decide how much you’re willing to gain or lose. Stick to these limits and avoid letting emotions take control. If the price hits your stop-loss, close the trade and move on.

5. Check Your Margin Level Regularly

Make it a habit to check your margin level often. This helps you stay aware of your account status and take action early if it starts to get too low. Exness provides real-time updates to make this easy.

6. Avoid Overtrading

Overtrading can deplete your margin in no time, and raise your margin call risk. Trade only if you have a well-defined plan. Simplicity and mountain of the trades is the key, it keeps you in control.

Properly managing your margin can be done by following these strategies to mitigate risk and prevent margin calls on your account. Margin management made simple and smart is the secret to Exness trading success!

Frequently Asked Questions (FAQ)

What is a margin level in trading?

The margin level is a percentage that shows how much money you have in your account compared to the money needed to keep your trades open. A higher margin level means you’re safe, with more funds available. A lower margin level means you’re close to a margin call, where you may need to add more funds or close some trades.

How is margin level calculated on Exness?

Simply put, margin level = equity / used margin × 100 Example: If your equity is $5,000 and your used margin is $1,000, your margin level will be 500%. A higher margin level means more equity compared to the margin used for your trades.

What margin requirements does Exness have for different instruments?

Exness requires different margins depending on what you’re trading. For major forex pairs, the margin is usually 0.10% to 1%. Commodities like gold may need 1% to 5%, while stocks and cryptocurrencies can require 2% to 10%. Always check the margin requirements before opening a trade.

How do I know if I’m approaching a margin call on Exness?

All the way through the same, Exness will inform you if your margin level is low. Your margin level can also be checked on the platform itself. If it’s approaching 100%, you risk a margin call. You might have to fund more, close some open trades or reduce position sizes at that point.

You may also be interested in: