Swap-Free Pairs on Exness

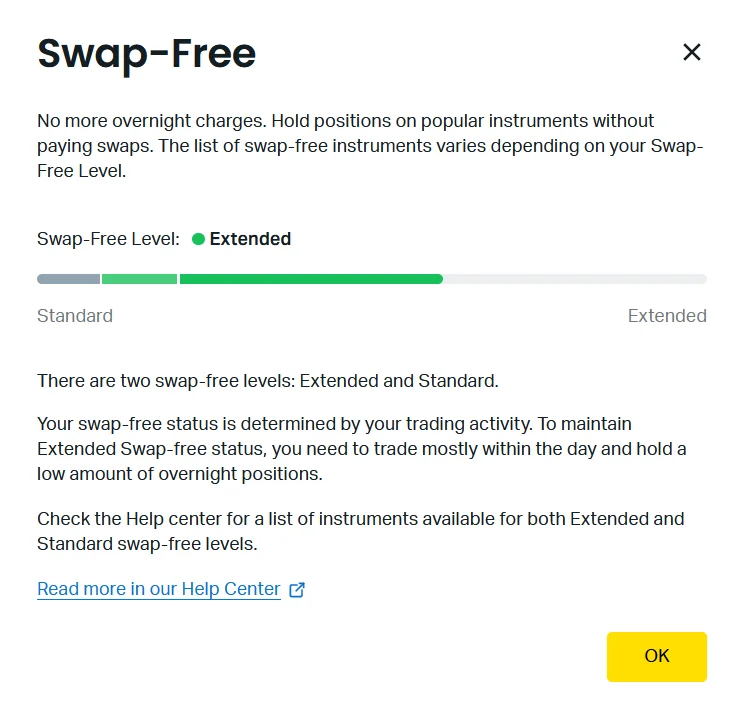

Swap-free pairs on Exness are currency pairs that don’t have swap fees. Normally, swap fees are charged when you hold a trade overnight. These fees are based on the difference in interest rates between the two currencies. Swap-free pairs let you avoid those fees, which can be helpful for traders who want simpler costs or for religious reasons.

What is a Swap Fee and Why is it Charged?

A swap fee is a charge that traders pay or receive when they keep a position open overnight. It happens because currencies have different interest rates. If you buy a currency with a higher interest rate and sell one with a lower rate, you might receive a swap fee. If the opposite happens, you might need to pay a swap fee.

Brokers charge swap fees to cover the cost of holding a position overnight. The fee depends on the difference in interest rates and is usually added to or subtracted from your account balance at the end of the day.

Swap fees can add up if you hold trades for a long time. That’s why some traders prefer swap-free accounts to avoid paying or receiving these fees.

List of Swap-Free Pairs on Exness

Exness offers several swap-free pairs for traders who want to avoid paying overnight swap fees. Some of the most popular swap-free currency pairs include:

EUR/USD

GBP/USD

USD/JPY

AUD/USD

USD/CHF

EUR/GBP

These pairs are commonly used, but the full list may vary. You can check the available swap-free pairs in your Exness account or ask Exness support for more details.

Advantages and Disadvantages of Trading Swap-Free Pairs

Advantages:

- No Swap Fees: The biggest benefit is that you don’t pay swap fees when holding positions overnight. This makes it easier to calculate your costs.

- Simpler Cost Structure: Without swap fees, it’s easier to see how much you’re actually paying to hold a trade. This can help you make clearer decisions.

- Good for Religious Traders: Swap-free accounts are helpful for traders who cannot pay interest for religious reasons. They comply with Islamic finance principles.

- Hold Positions Longer: You can keep positions open for a longer time without the added cost of swap fees. This is useful for traders with long-term strategies.

Disadvantages:

- Limited Pair Selection: Not all currency pairs are available as swap-free pairs. You may only have a limited choice, mostly with major currencies.

- Wider Spreads: Sometimes, swap-free pairs have wider spreads than regular pairs. This can make your entry and exit costs a bit higher.

- Not Good for Swap Income: If you rely on earning swap income (from holding positions long-term), swap-free pairs may not be the best choice for you.

- Some Features May Be Limited: Swap-free accounts might have fewer features or options compared to regular accounts. Be sure to check what is available before choosing swap-free pairs.

Features of Position Management on Swap-Free Instruments

With swap-free instruments, you don’t have to worry about paying swap fees for holding positions overnight. This makes it easier to keep your trades open for longer periods. However, swap-free pairs may have wider spreads compared to regular pairs, so you might pay more when opening or closing a trade.

You still need to manage your positions carefully. Even without swap fees, you need to watch your leverage and your margin levels. Use too much leverage, and you could get a margin call. Keep an eye on your margin to prevent surprises. In summary, managing swap-free positions is simple, but monitoring your trades and costs is still necessary.

Recommendations for Effective Use of Swap-Free Pairs

To use swap-free pairs effectively, consider these simple tips:

- Choose Based on Your Trading Style: Swap-free pairs are best for long-term traders. If you plan to hold trades for days or weeks, swap-free can be a good option. For short-term trades, the wider spreads might make them less ideal.

- Stay Updated on Market News: Even without swap fees, the market can still change quickly. Keep an eye on news and events that can affect your trades. This will help you adjust your strategy if needed.

- Be Aware of the Costs: While swap-free pairs don’t have swap fees, they can have wider spreads. Always check the spread before making a trade to understand your costs.

- Use Risk Management Tools: Setting stop-loss and take-profit orders will help you protect your trades. Even without swap fees, risk management is important to limit losses and lock in profits.

By following these tips, you can make better use of swap-free pairs and improve your overall trading strategy.

Frequently Asked Questions

Who can access swap-free pairs on Exness?

Anyone can use swap-free pairs on Exness by opening a swap-free account. This type of account is perfect for traders who want to avoid swap fees. It’s especially helpful for those who follow Islamic trading rules. You just need to choose the swap-free option when you create your Exness account.

Are there any hidden fees when trading swap-free pairs on Exness?

No, there are no hidden fees for trading swap-free pairs on Exness. However, swap-free pairs might have wider spreads than regular pairs. This means that while you don’t pay swap fees, the cost of opening and closing trades could be higher. Always check the spread before you trade to understand the costs.

How do swap-free pairs affect long-term trading strategies?

Swap-free pairs is useful for long-term trading as you don’t have to pay swap fees every night. That can make it less expensive to keep positions open over time. However, swap-free pairs may have wider spreads, which could affect your profit when entering or exiting trades. So, while they help reduce overnight fees, the wider spreads should be considered in your long-term strategy.

Can I switch between swap-free and regular accounts on Exness?

Yes, you can switch between swap-free and regular accounts on Exness. However, you may need to close your positions and open a new account type. Contact Exness support to make sure everything is set up correctly without any problems.

Are swap-free pairs available for all types of instruments on Exness?

Forex pairs such as EUR/USD and GBP/USD have swap-free pair options. But they may not exist for different assets like commodities, indices, or cryptos. Make sure that swap free conditions are applicable to a specific pair that you want to trade.

You may also be interested in: