Exness HMR Trading Timeframes

In trading, timeframes help you see how prices change over different periods. On Exness, HMR trading timeframes let you analyze the market and make better decisions. Whether you want to trade quickly or hold positions for longer, understanding timeframes is essential.

This guide will explain what HMR periods are, the timeframes available on Exness, and how to use them to improve your trading.

What Are Exness HMR Periods in Trading?

HMR periods are time intervals used to track price movements in the market. They help traders study how prices change over short or long periods. For example, a 1-minute chart shows price changes every minute, while a daily chart shows all the price movements in one day.

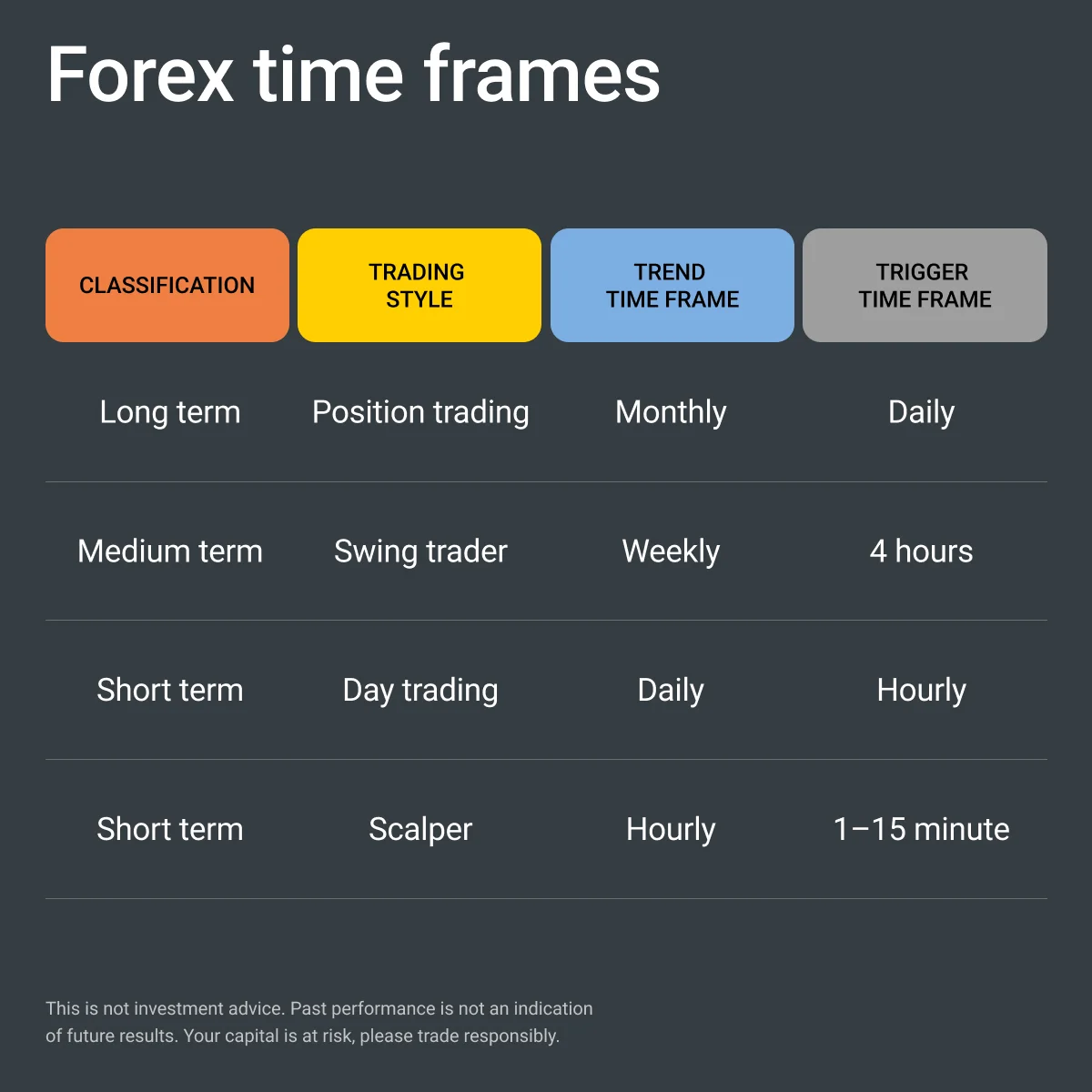

Short timeframes are great for quick trades, as they show small and frequent price changes. Medium timeframes are ideal for trades that last a few hours or days, while long timeframes give a big-picture view of the market for long-term planning.

With HMR periods on Exness, you can analyze trends, spot patterns, and decide the best times to trade. They make it easier to understand the market, whether you’re trading short-term or long-term.

Available Timeframes for HMR Trading on Exness

Exness offers different timeframes to suit all types of traders. Short-term timeframes, like 1-minute (M1) and 5-minute (M5) charts, are great for fast trades. Medium-term timeframes, such as 1-hour (H1) and 4-hour (H4) charts, work well for holding trades over a day or two. Long-term timeframes, like daily (D1) or weekly (W1) charts, are best for understanding larger trends.

Switching between timeframes on Exness is simple. This flexibility lets you look at the market from different angles, helping you make smarter decisions. Whether you trade quickly or plan for the long term, there’s a timeframe for every style.

Characteristics of Trading During Different Exness Timeframes

Different timeframes on Exness suit different trading styles. Price movements being captured are relatively fast such as on the 1-minute or 5-minute charts within short-term timeframes. They are perfect for traders that want to carry out fast trades, but can become exhausting and involve quick decision making.

Medium-term timeframes are more relaxed (1-hour, 4-hour charts) These charts help traders clearly see trends and make decisions without the pressure of time. These are commonly used for swing traders who hold for a day or two.

Daily or weekly charts are considered long-term timeframes for traders trading the market as a whole. They don’t need hands-on monitoring and are more beneficial to those who like fewer trades and longer-term thinking.

Choosing the Optimal Exness Timeframe for HMR Strategies

Choosing the best timeframe depends on how you like to trade and how much time you have. If you want quick trades and can focus on the market, short-term timeframes like 1-minute or 5-minute charts work well. They are ideal for scalping strategies.

If you prefer a balance between activity and time, medium-term timeframes such as 1-hour or 4-hour charts are a good option. They let you trade without being tied to your screen all day.

For traders with limited time, long-term timeframes like daily or weekly charts are better. They focus on big trends and allow you to trade with less stress. The key is to match your timeframe with your strategy and daily routine.

Practical Tips for Managing Time in Exness HMR Trading

Managing your time well is important for successful trading. Start by picking a timeframe that fits your schedule. If you’re busy, choose long-term charts like daily or weekly ones. These don’t need constant monitoring. If you have more time, shorter timeframes like 5-minute or 15-minute charts can be used for faster trades.

Set aside specific times to check the market and make trades. This helps you stay focused and avoid overtrading. Use tools like alerts on Exness to notify you about market changes, so you don’t have to watch the screen all the time.

Finally, review your trades regularly. Look at what worked and what didn’t to improve your strategy. Good time management keeps trading simple, productive, and less stressful.

Frequently Asked Questions (FAQ)

What are the main HMR timeframes available on Exness?

Exness offers different timeframes for traders. 1-minute (M1) and 5-minute (M5) charts are the best for quick trades. These medium-term timeframes (like 1-hour (H1) and 4-hour (H4) allow traders to identify trends that unfold over a matter of hours or days. Longer timeframes such as daily (D1) and weekly (W1) charts reveal larger market trends and shall be used for longer-term strategies. These timeframes help traders pick what suits their style.

How do I switch between timeframes on the Exness platform?

Switching timeframes on Exness is easy. Even a cranky old man like myself can click on the timeframe desired, M1, H1, or D1 and the chart updates in real-time. Works for web, desktop and mobile apps. It makes allows you to view the market with a few different eye colors, each particuler eye helps you trade better

Which Exness HMR timeframe is best for beginners?

Introductory segment: Best timeframes for beginners are medium-term timeframes, like 1-hour (H1) or 4-hour (H4). They are easily trackable and display obvious trends. This way, the patterns provide beginner traders more time to study the market and formulate considered decisions. Based on your trading style, you can experiment with shorter or longer timeframes as you become more experienced.

You may also be interested in: