Exness Oil Trading

Exness Oil trading allows you the opportunity to trade one of the world’s most sought-after commodities. From beginners to experienced traders, Exness has the tools, resources and support you need to gain confidence trading oil. The flexible solutions offered and the competitive spreads ensure trading oil stays simple and reachable with Exness.

What is Oil Trading?

All you need to know about trading oil is how to read the price fluctuations of crude oil in the international market. It is also a popular choice among traders, as oil prices are affected by a plethora of factors, including but not limited to supply and demand dynamics, geopolitical developments and economic changes. This enhances it a dynamic and interesting industry.

When you set about buying or selling oil at Exness, you aren’t actually buying or selling oil in its physical form. Instead, what you are doing is trading CFDs (Contracts for Difference). This means you can make a profit off price changes regardless of whether oil prices rise or decline. It’s a way to get involved in the oil market without having to store or transport the commodity.

Types of Oil Instruments Available on Exness

Exness offers different ways to trade oil, catering to a variety of trading strategies. The main oil types you can trade are:

| Type of Oil | Description |

| Brent Crude | This is a global benchmark for oil prices and comes from the North Sea. |

| WTI Crude | Known as West Texas Intermediate, it is a lighter and sweeter oil mainly traded in the U.S. |

You can trade these types of oil in flexible ways:

- Spot Contracts: Trade at the current market price for quick opportunities.

- Micro-Lots: Start small and manage your risk while learning the market.

- CFDs on Futures: Speculate on where oil prices will go in the future without holding the physical contract.

With the tightest spreads, fast execution, and stable platforms, Exness lets you focus on informed trading decisions. Exness has the oil instruments you need, whether you’re looking to trade short-term or create a longer strategy.

Key Features of Oil Trading on Exness

Trading oil with Exness is easy and efficient, thanks to its useful features. Low spreads help keep your trading costs low. You can also use flexible leverage, which allows you to trade larger positions while controlling your risk.

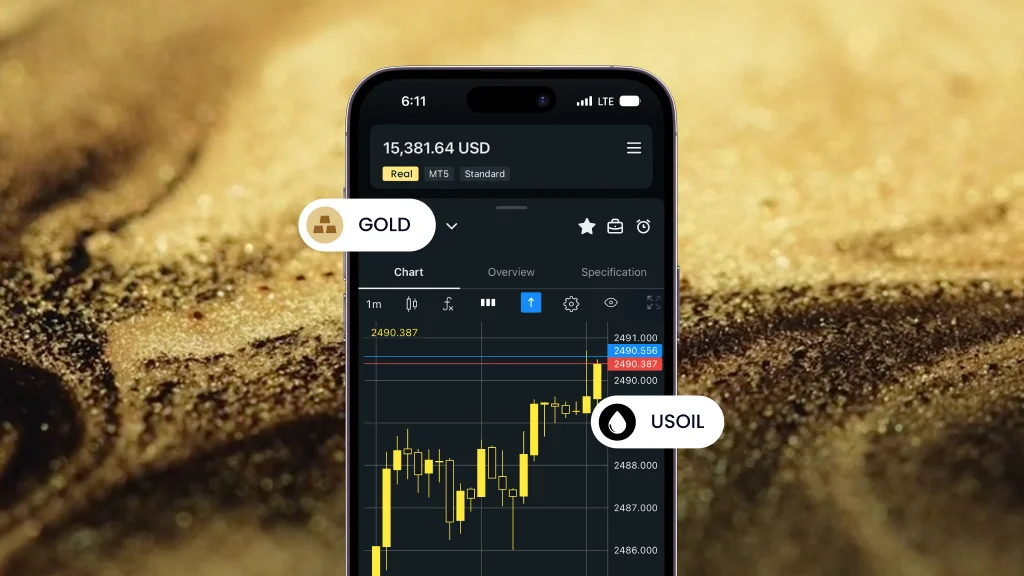

The platforms, like MetaTrader 4 and 5, are simple to use but packed with tools like live charts and indicators to help you make better decisions. Trades are executed quickly, so you don’t miss opportunities.

If you don’t want overnight fees, Exness offers swap-free accounts. Plus, their 24/7 support is always there if you need help.

Factors Influencing Oil Prices in Exness Markets

Oil prices are shaped by various factors that make the market dynamic and exciting to trade. Supply and demand play a major role. When supply drops due to production cuts or disruptions, prices typically rise. On the other hand, weak demand can push prices lower.

Geopolitical events often cause price swings. Conflicts or political instability in oil-rich regions can disrupt supply and lead to higher prices. Weather can also have an impact. Storms or harsh conditions in production areas can affect the availability of oil, influencing market prices.

Economic conditions are another key driver. When economies are growing, the demand for oil increases, lifting prices. In contrast, during slowdowns, demand may fall, putting downward pressure on prices. Decisions made by OPEC, an organization that controls much of the world’s oil supply, are also critical. Their policies on production levels directly affect global oil prices.

Understanding these factors helps traders anticipate market movements and make more informed trading decisions.

Strategies for Trading Oil Assets on Exness

Successful oil trading starts with a plan. Here are a few simple strategies:

- Follow the trend: Trade in the same direction as the market. If prices are going up, buy. If they’re falling, sell.

- React to news: Watch for big announcements, like OPEC updates or political events, and trade based on their impact.

- Make quick trades: Use scalping to profit from small price changes. Exness’ fast trading platform is great for this.

- Trade ranges: Identify levels where prices bounce up and down, and trade within those limits.

- Hedge your risk: Open opposite trades to reduce your losses during uncertain times.

These simple strategies work well with Exness’ tools and fast execution. Start with one that suits your style and grow from there.

Frequently Asked Questions

What types of oil can I trade on Exness?

Two of the most traded oil types, Brent Crude and West Texas Intermediate (WTI), are also available on Exness. Brent Crude is the world’s benchmark for oil prices, while WTI is used mainly in the United States. An interesting market for traders well known for its high liquidity and volatility.

What leverage is available for oil trading on Exness?

The broker provides leverage for oil trading and does not set limits either high or low, leaving things open to you to decide as always from your strategy and tolerance level. Using leverage enables you to control larger positions with less capital, but it’s a double-edged sword — it could amplify profits or losses.

Are there specific trading hours for oil on Exness?

Yes, oil trading on Exness follows market hours. Generally, trading is available from Monday to Friday, with some breaks for maintenance. The exact trading hours may vary depending on the oil type and global market schedules. You can check the detailed trading hours directly on the Exness platform for real-time updates.

What spreads can I expect for oil trading on Exness?

Exness offers low spreads on oil trading. These spreads are built with affordability and trading efficiency in mind. The spread may change in accordance with market conditions and which account you use. Use your trading platform to see the current spreads on the various pairs in real time.

You may also be interested in: