Exness Islamic Account

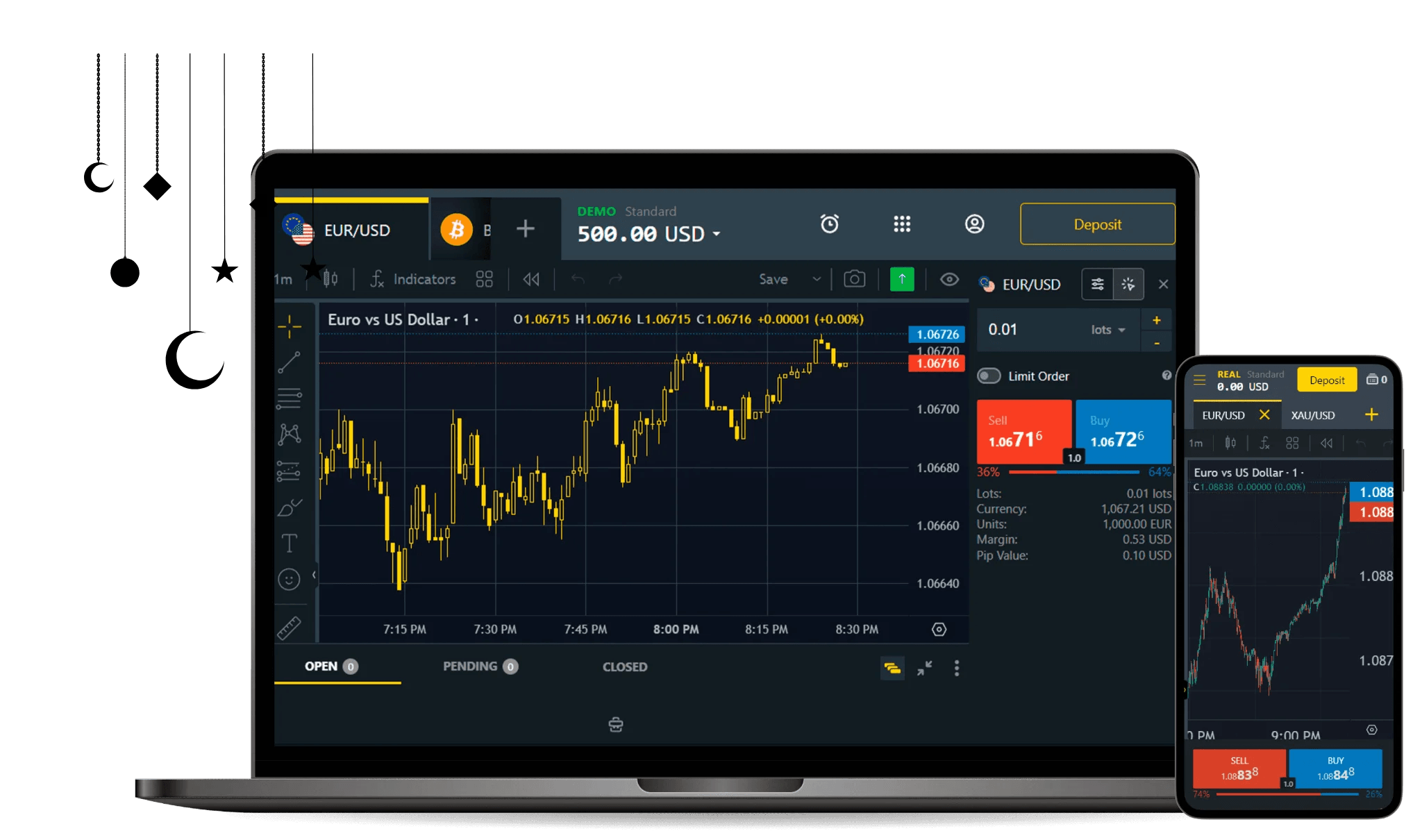

Trading should be accessible to everyone, regardless of their beliefs. That’s why Exness offers an Islamic Account, designed specifically for Muslim traders who want to follow Sharia law while participating in the forex market.

With this account, there are no swap fees or interest charges on overnight positions. You get the same fast execution, tight spreads, and flexible trading conditions as a regular account—just without the elements that go against Islamic finance principles.

What is an Islamic (Swap-Free) Trading Account?

TA swap-free trading account is a special type of forex account made for traders who follow Islamic finance rules. In standard forex trading, if you leave a trade open overnight, you may have to pay or receive interest (also known as a swap fee). This goes against Riba, which is prohibited in Islam.

With an Islamic Account, those swap fees are removed. Instead, Exness ensures fair and transparent conditions, allowing traders to hold positions without worrying about interest-based costs. Everything else remains the same—you can trade forex, metals, indices, and other assets while enjoying tight spreads and flexible leverage. This way, you can focus on your strategy, knowing your trades are fully compliant with Islamic principles.

Who Needs an Islamic Account?

An Islamic account is for Muslim traders who want to follow Sharia law while trading. In Islam, interest (Riba) is not allowed. Standard trading accounts charge swap fees, which are a type of interest. An Islamic account removes these fees, making it Halal for trading.

This account is also useful for traders who hold positions overnight and want to avoid extra costs. It offers fair trading conditions without interest, making it a good choice for both beginners and experienced traders.

Countries for Which Exness Provides Access to Islamic Accounts

Exness offers Islamic accounts in many countries, especially in Muslim-majority regions. If you live in one of these countries, you can open an Islamic trading account.

Here are some places where swap-free accounts are available:

Middle East

Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain

North Africa

Egypt, Algeria, Morocco, Tunisia

Asia

Indonesia, Malaysia, Pakistan, Bangladesh

Other Regions

Some Muslim communities in other parts of the world

If you are unsure, you can check the Exness website or contact customer support.

Account Types Compatible with Islamic Trading

Exness offers different account types for Islamic traders. You can choose the one that fits your trading style.

Here are the Islamic account options:

| Account Type | Features | Islamic Account Available? |

| Standard | No commission, low spreads, good for beginners | ✅ Yes |

| Standard Cent | Small trades, low risk, best for learning | ✅ Yes |

| Pro | Tighter spreads, fast execution | ✅ Yes |

| Raw Spread | Spreads from 0.0 pips, commission-based | ✅ Yes |

| Zero | Zero spread on some pairs, fixed commission | ✅ Yes |

If you open an account in a country that allows Islamic trading, your account will be swap-free automatically. If you already have an account, you can request to convert it to an Islamic account through Exness support.

This way, you can trade without interest and still enjoy all the benefits of a professional trading account.

How to Start Using Exness Islamic Swap-Free Account

Getting started with an Exness Islamic account is easy. Whether you are a new trader or already have an Exness account, you can begin trading without swap fees in just a few steps.

If you don’t have an account yet, follow these simple steps:

- Sign up on the Exness website.

- Choose your account type (Standard, Pro, Raw Spread, or Zero).

- Select your country during registration. If your country is eligible for an Islamic account, it will be swap-free automatically.

- Verify your identity by submitting the required documents (see below).

- Deposit funds and start trading.

If you already have an Exness account but it is not swap-free, you can request a conversion to an Islamic account. Just contact Exness support, and they will help you with the process.

6 Asset Classes – 16 Trading Platforms – Over 1000 Instruments.

Trade Forex, Individual Stocks, Commodities, Precious Metals, Energies and Equity Indices at Exness.

Required Documentation

Before you can start trading, you need to verify your account. This is a standard security process that helps keep your funds safe and ensures smooth trading.

You will need to provide:

- Proof of Identity – A passport, national ID, or driver’s license.

- Proof of Residence – A utility bill, bank statement, or any official document with your address.

- Proof of Payment Method (if required) – Some payment systems may need extra verification.

Uploading these documents takes just a few minutes. Once your account is verified, you can deposit money and start trading with your swap-free Islamic account. If you need help, Exness customer support is available 24/7.

Features of the Islamic Account

The Exness Islamic Account is designed for traders who want to trade without interest while following Sharia law. It works like a regular account but does not have swap fees on overnight positions.

This account provides low spreads, fast execution, and flexible leverage. It is a fair and transparent way to trade while staying compliant with Islamic finance principles.

This table gives you a quick look at the options, so you can see what each method offers. You can choose based on how quickly you want funds available, your budget, and whether you prefer a certain method. It’s designed to make deposits and withdrawals as easy as possible.

Spreads and Commissions

Exness Islamic accounts offer tight spreads and no hidden charges. There are no swap fees, and Standard accounts have no commission. Raw Spread and Zero accounts have a fixed commission, so costs are clear and predictable.

Leverage Options

Islamic accounts offer high leverage, allowing traders to open larger positions with a small investment. The leverage can go up to unlimited, depending on the account type and region. Dynamic leverage is also available, adjusting based on trading volume.

Minimum Deposit Requirements

The minimum deposit depends on the account type. Standard and Standard Cent accounts do not have a fixed minimum, making them great for beginners. Pro, Raw Spread, and Zero accounts require at least $200 to start trading.

| Account Type | Minimum Deposit |

| Standard | No fixed minimum |

| Standard Cent | No fixed minimum |

| Pro | $200 |

| Raw Spread | $200 |

| Zero | $200 |

Trading Platforms Available

Exness Islamic accounts can be used on different platforms, including MetaTrader 4, MetaTrader 5, Exness Terminal, and the Exness Trader App. Traders can access their accounts from a computer, web browser, or mobile phone, making it easy to trade anytime and anywhere.

The Exness Islamic Account is a great option for Muslim traders. It offers fair trading conditions, no swap fees, and advanced trading tools while following Islamic finance rules.

FAQ

What makes Exness Islamic Account different from a standard trading account?

The Exness Islamic Account is the same as a standard trading account but without swap fees on overnight positions. This makes it fully compliant with Sharia law, ensuring that traders can participate in the forex market without paying or receiving interest. Other trading conditions, including spreads, leverage, and execution speed, remain the same.

Can I convert my existing Exness account to an Islamic Account?

Yes, if you already have an Exness account, you can request a conversion to an Islamic account by contacting customer support. If you open a new account from a country where Islamic trading is available, it will be automatically swap-free without needing any extra steps.

Are there any special fees or charges for Islamic Account holders?

There are no swap fees on Islamic accounts, but on some instruments, a small administration fee may apply instead. This fee is fixed and is not interest-based, ensuring that the account remains fully compliant with Islamic finance principles. You can check any applicable fees directly on the Exness trading platform before placing a trade.

What trading instruments are available on an Exness Islamic Account?

Exness Islamic accounts allow trading in forex, metals, indices, energies, stocks, and cryptocurrencies, just like standard accounts. All these instruments are available without swap fees, so traders can trade freely while following Islamic finance rules.

You may also be interested in:

6 Asset Classes – 16 Trading Platforms – Over 1000 Instruments.