Exness Boom and Crash – Does the Broker Offer This at All?

Many traders are curious if Exness offers Boom and Crash indices. These indices are well-known for their unique price movements. But does Exness provide them? In this article, we’ll answer that question and explain what Exness offers instead.

Definition of “Boom and Crash” in the Context of Trading

“Boom and Crash” are special types of synthetic indices. They are not based on real-world assets like stocks or currencies. Instead, they are designed to mimic market movements with sharp changes in price.

- Boom Indices: These are markets where the price suddenly rises in big jumps, called “booms.” Traders try to predict when the next rise will happen.

- Crash Indices: In these markets, the price drops quickly in sharp movements, called “crashes.” Traders aim to profit by predicting when the next drop will occur.

Boom and Crash indices are popular because they are highly volatile, meaning their prices can change quickly. This gives traders the chance to make profits from fast price movements. These indices are different from regular markets and are mainly available on brokers like Deriv. But do they exist on Exness? Let’s find out.

Does Exness Offer a Separate “Boom and Crash” Tool?

No, Exness does not offer Boom and Crash indices. These special synthetic indices are not available on the Exness platform. Exness focuses on forex trading, commodities, and traditional indices, but Boom and Crash are not part of their selection. If you’re looking to trade Boom and Crash, you will need to use a different broker like Deriv.

Why Do Users Think Exness Offers This?

Some traders think Exness offers Boom and Crash indices because the broker is well-known and offers many other trading tools. Exness has a strong reputation in the trading community, so it’s easy to assume that they would provide these popular indices. However, this is a misconception. Exness does not have Boom and Crash in their list of products, even though many traders might expect them to.

What Does Exness Offer Instead of Boom and Crash?

While Exness doesn’t offer Boom and Crash indices, it provides a wide range of other trading options. Traders on Exness can access:

- Forex Pairs: Exness offers numerous currency pairs, including major, minor, and exotic pairs.

- Commodities: Exness provides access to commodities like gold, silver, oil, and agricultural products.

- Stock Indices: They allow you to trade on indices like the S&P 500, NASDAQ, etc.

- Cryptocurrencies: Exness provides popular cryptocurrencies such as Bitcoin, Ethereum, and Litecoin.

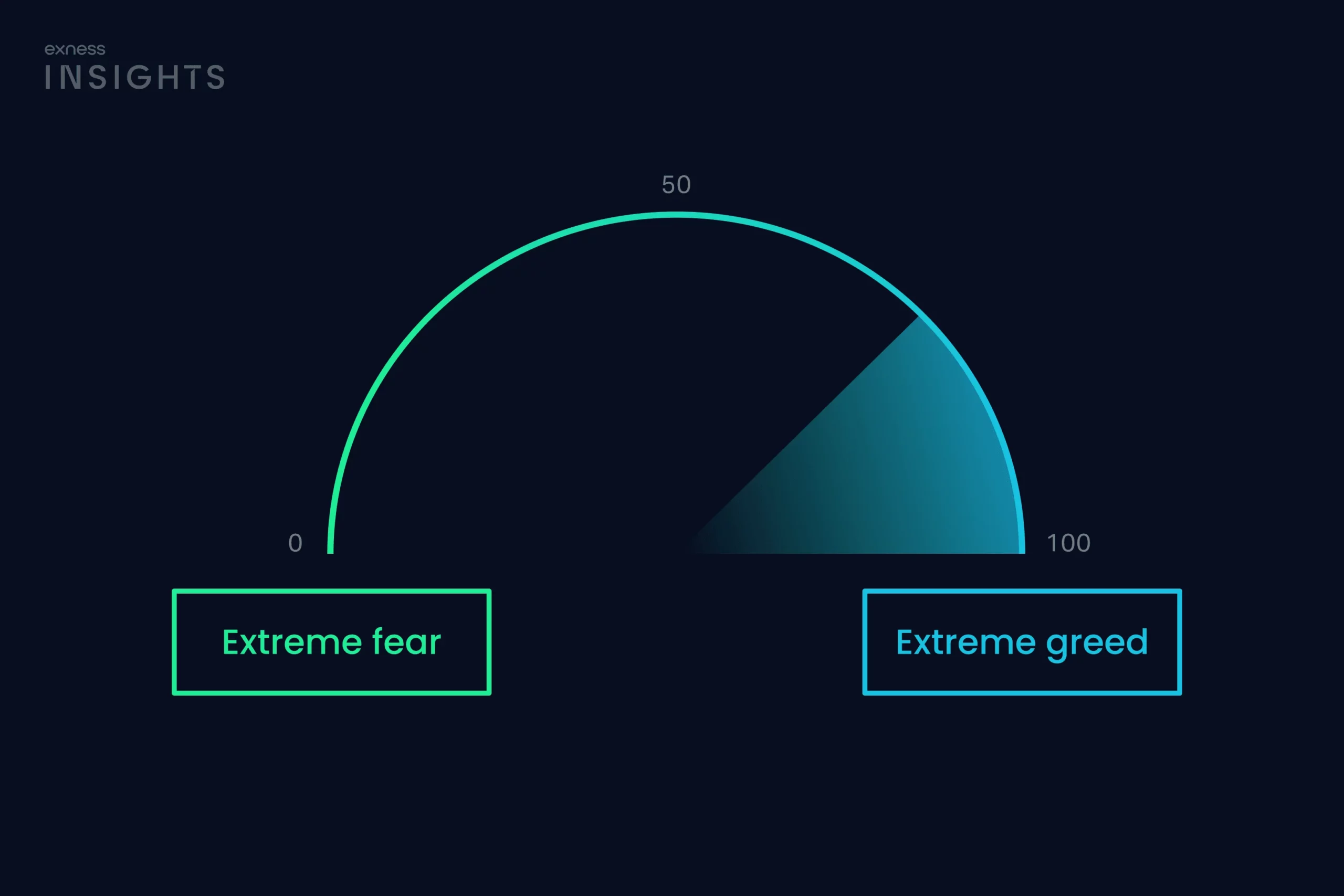

Traders looking to capitalize on these assets may find themselves more profitable and execute more trades due to the liquidity and the way trends behave as opposed to the higher volatility found in more synthetic indices such as Boom and Crash. Exness also has some extremely volatile forex pairs and commodities for those seeking volatility to trade.

Frequently Asked Questions (FAQs)

What are Boom and Crash indices in trading?

The Boom and Crash indices are synthetic markets designed to mimic rapid and extreme price movements. Boom indices have sudden upward price spikes, while Crash indices have rapid price drops. Traders often attempt to anticipate when these price movements will occur to generate a profit. Such indices are one of the highest volatile indices known to traders searching for fast and dynamic trading.

Does Exness offer synthetic indices like Boom and Crash?

No, Exness does not offer synthetic indices such as Boom and Crash. While Exness provides a variety of trading instruments like forex pairs, commodities, and stock indices, it does not include the synthetic indices that are characteristic of platforms like Deriv. Traders looking for Boom and Crash need to consider other brokers that specialize in these types of markets.

Why do traders associate Boom and Crash with Exness?

As a result, some traders actually associate Exness with Boom and Crash, because of the broker’s wide popularity and diverse products to trade. Given that Exness has many tools and assets to trade with, beginner or inexperienced traders often wrongly associate Boom and Crash indices among the assets they offer. This is a misconception, because Exness does not offer these synthetic indices.

What are the alternatives to Boom and Crash available on Exness?

Even though Exness does not offer Boom and Crash, there are still other trading options that provide similar opportunities for volatility. Exness offers forex pairs with high volatility, such as GBP/USD and USD/JPY, which can see rapid price movements. The broker also provides commodities like gold and oil, which can experience fast and significant price changes. In addition, stock indices such as the S&P 500 also offer traders the chance to trade in markets with strong price fluctuations, making them suitable alternatives for those seeking high-risk, high-reward opportunities.

You may also be interested in: