Exness BTCUSD Trading

Trading BTCUSD at Exness is a digital market trading experience that is both straightforward and thrilling. It’s ideal for anyone who wants to trade cryptocurrency markets in-depth, at low trading cost and with a variety of options.

Exness BTCUSD Trading Concept

BTCUSD trading means trading the price movement of Bitcoin (BTC) against the US Dollar (USD). This trading pair, at its core, is a combination of the global stability of the US dollar with the high volatility of Bitcoin; therefore, it is especially attractive to both novice and experienced traders.

Discover how Bitcoin BTCUSD works with Exness’ tradeable Contracts for Difference (CFDs). This means you can profit from Bitcoin price movements without owning Bitcoin itself. Regardless of whether the market goes up or down, there are positions to take, and profits to earn. This flexibility is a significant benefit for traders looking to navigate the crypto market.

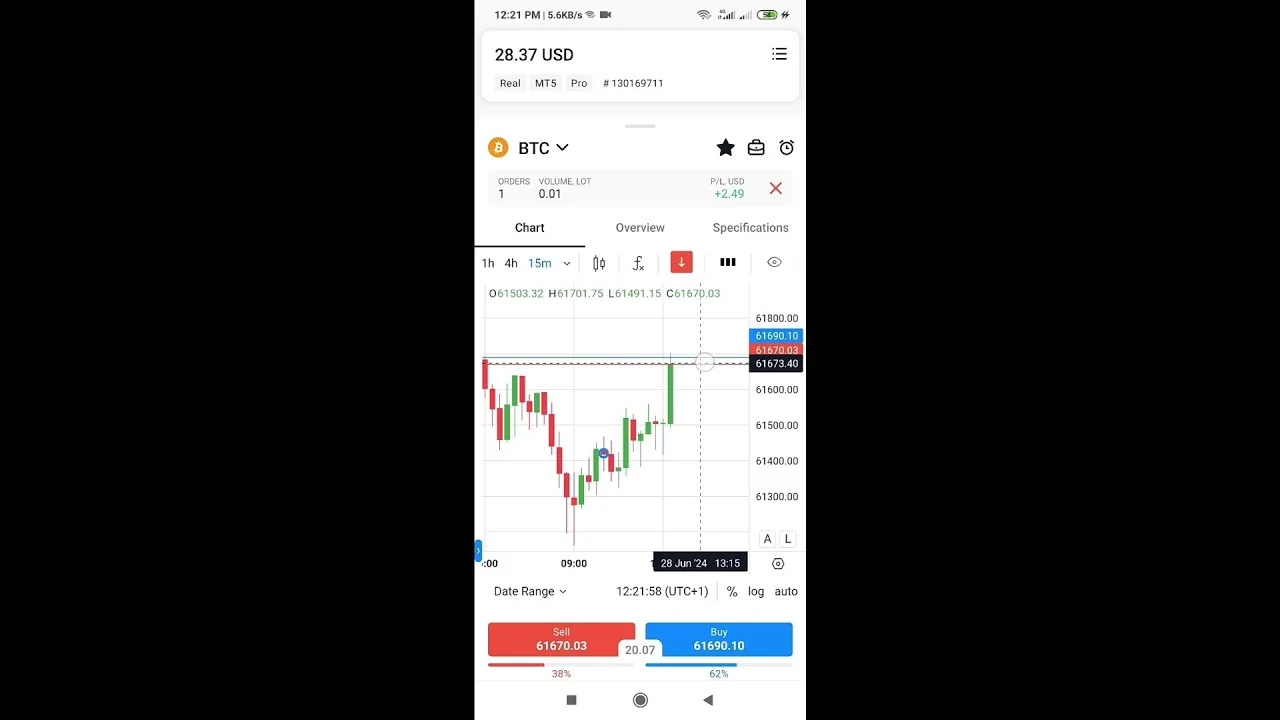

Exness also offers you tools such as leverage. This not only increases potential gains, but also magnifies risks, so risk management is needed. With real-time market updates, professional charting tools, and reliable execution, traders will have access to everything that they need through Exness to trade BTCUSD.

Key Features of BTCUSD Trading on Exness

Exness offers several key features that make BTCUSD trading simple and efficient. Here’s what you can expect:

- Low Trading Costs: Exness provides tight spreads, which means you save money on every trade. This is especially useful for frequent traders.

- Flexible Leverage: You can choose the leverage level that suits your risk tolerance, allowing for more control over your trades.

- Round-the-Clock Trading: Unlike traditional markets, Bitcoin trading is available 24/7. This gives you the freedom to trade whenever it suits you, even on weekends.

- Powerful Tools: Exness offers advanced charting and technical indicators, so you can analyze the market and make informed decisions.

- Demo Account: For beginners, Exness provides a risk-free demo account where you can practice BTCUSD trading before using real money.

- Quick Execution: Orders on Exness are executed instantly, ensuring you don’t miss out on market opportunities.

These features are designed to make BTCUSD trading straightforward, flexible, and cost-effective. Whether you’re testing strategies on a demo account or trading live, Exness offers everything you need to succeed.

Volatility and Liquidity Analysis for BTCUSD on Exness

An attractive trading pair for crypto traders looking for high potential returns is BTCUSD which has the highest volatility of any trading pair on Exness. Bitcoin’s price can fluctuate quickly on news about markets, economic shifts, or even trends on social media. This volatility creates opportunities, but also carries risk, so knowing it can be critical.

Exness offers great liquidity for BTCUSD. The ability to open and close business without delay thanks to the trading volume and market access around-the-clock. Exness further offers tight spreads, thereby providing additional liquidity for trading at an economical price. BTCUSD trading on Exness blends volatility with liquidity, making it an exhilarating but approachable environment for thoroughly prepared traders.

Optimal Strategies for BTCUSD Trading on Exness

Trading BTCUSD on Exness can be rewarding if you apply the right strategies. Here are some practical approaches:

- Trend-Following Strategy: Identify the overall market direction using indicators like moving averages or trend lines. Trade in the same direction as the trend, buying during an uptrend or selling during a downtrend. This strategy works best in markets with clear, sustained movements.

- Range Trading Strategy: Focus on BTCUSD when the price moves within a range, bouncing between support and resistance levels. Buy near the support level and sell near the resistance. This approach is ideal for periods of lower volatility.

- Breakout Strategy: Watch for moments when BTCUSD breaks through important resistance or support levels. These breakouts often signal the start of strong price movements. Enter trades once the breakout is confirmed and follow the momentum.

- Scalping Strategy: Aim to capture small, frequent price changes over short timeframes. This strategy is perfect for traders who prefer quick trades and have time to monitor the market closely. Exness’s fast execution supports this approach effectively.

- News-Based Strategy: Stay updated on Bitcoin-related news and global events that affect its price. Sudden announcements can create opportunities for significant price movements. Use Exness’s economic calendar to plan trades around high-impact news.

These strategies are most effective when combined with strong risk management practices. Always set stop-loss and take-profit levels to protect your capital and maintain discipline. Adapt your strategy to market conditions to make the most of BTCUSD trading on Exness.

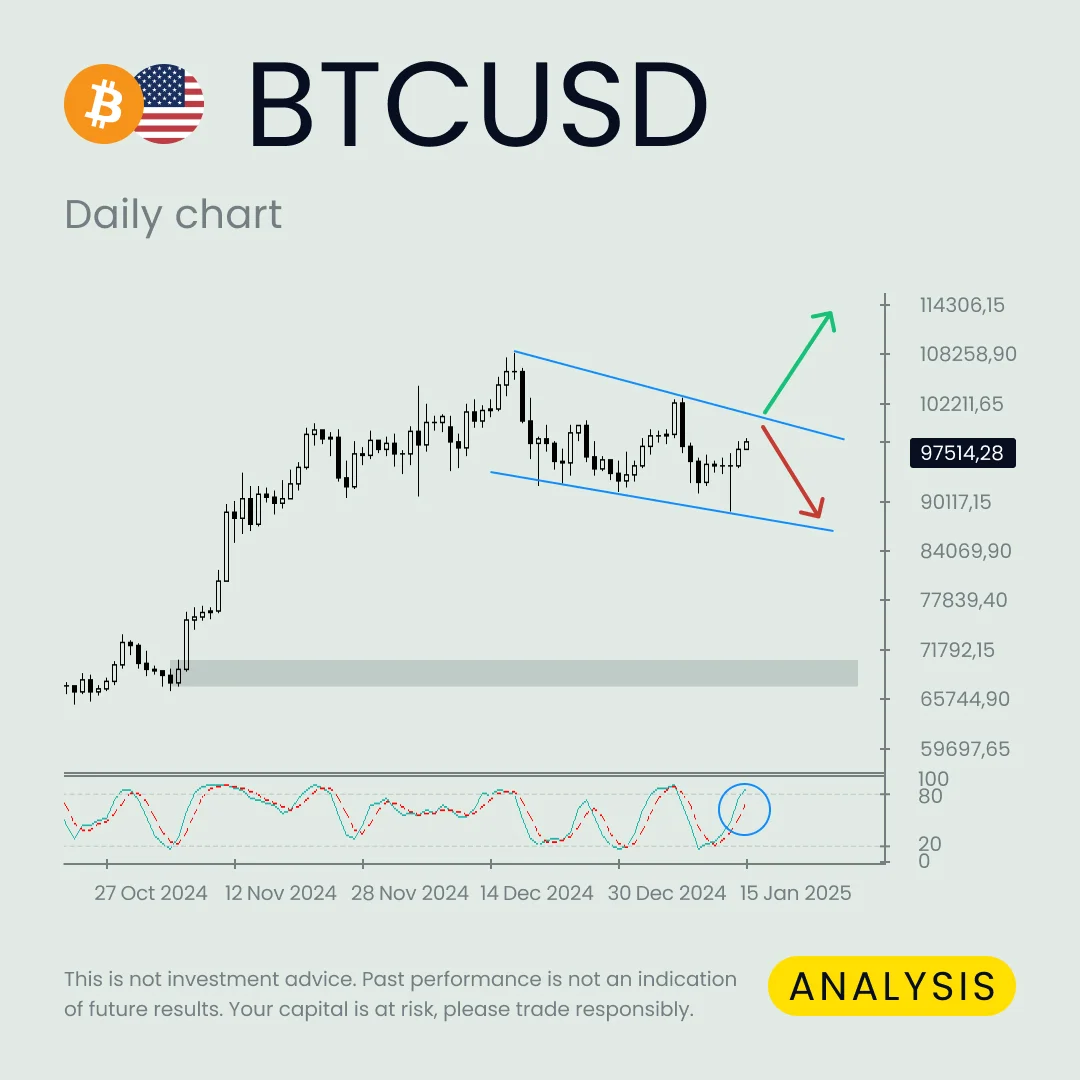

Technical Analysis of BTCUSD on the Exness Platform

Technical analysis is essential for understanding BTCUSD price movements. On the Exness platform, traders can use a variety of tools to analyze trends, identify patterns, and make informed decisions. Indicators like moving averages, RSI, and Bollinger Bands are available to help you spot opportunities in the market.

Example of Key BTCUSD Metrics on Exness

| Metric | Value | Description |

| Average Daily Volatility | $500 – $1,000 | BTCUSD often shows large daily price movements, creating opportunities for traders. |

| Spread (Typical) | 30 – 50 USD | Competitive spreads ensure low trading costs for BTCUSD on Exness. |

| Leverage | Up to 1:200 | High leverage allows traders to control larger positions with smaller capital. |

| Peak Trading Volume | Weekends and U.S. market hours | BTCUSD trading is highly active during these periods due to Bitcoin’s 24/7 market. |

| Support Level (Example) | $25,000 | A key price point where Bitcoin has historically found buyers. |

| Resistance Level (Example) | $30,000 | A key price point where Bitcoin has faced selling pressure. |

Using Exness Tools for Analysis

- Moving Averages: Smooth out price data to identify trends.

- RSI (Relative Strength Index): Detect overbought or oversold conditions.

- Bollinger Bands: Measure volatility and predict breakout opportunities.

By combining these tools with clear metrics, traders on Exness can perform precise and actionable technical analysis. This approach helps you plan better entry and exit points for your BTCUSD trades.

Frequently Asked Questions (FAQs)

What leverage is available for BTCUSD trading on Exness?

Exness offers flexible leverage for BTCUSD trading. The leverage you can use depends on your account type and the platform you are using. Leverage lets you trade with more funds than you have in your account. For example, with leverage of 1:100, you can control a $10,000 position with just $100. But remember, while leverage increases potential profits, it also increases risk. Use it carefully.

How does Exness handle BTCUSD volatility during high-impact events?

BTCUSD can be very volatile, especially during major market events. Exness handles this by providing tools to help you manage risk. You can use stop-loss and take-profit orders to protect your trades. These tools close your positions automatically when the price reaches your set level. Exness also ensures fast order execution, even during peak market activity. This helps you react quickly to sudden price changes.

What are the typical spreads for BTCUSD on Exness?

Spreads for BTCUSD on Exness are competitive and usually very tight. A smaller spread means lower trading costs, which is great for traders. The exact spread can change depending on market conditions, like during high volatility. Exness keeps spreads low most of the time, even when the market is active. You can check the current spread on the platform before making a trade.

Can I trade BTCUSD on Exness using a demo account?

Yes, Exness allows you to trade BTCUSD using a demo account. This is perfect for practicing and learning. A demo account uses virtual money, so there’s no risk of losing real funds. It’s a great way to try different strategies and get familiar with the platform. The best part is that the demo account mimics real market conditions, so you can prepare for live trading confidently.

You may also be interested in: