Exness Unlimited Leverage Trading Options

Traders at Exness can use unlimited leverage, which enables them to control bigger positions with less money. If all goes well, that can mean higher profits. So, despite its high potential of profit, it also has high risks, hence, use this option with precaution. Unlimited leverage is an excellent tool for experienced traders, however, it’s not for everyone.

What Is Unlimited Leverage on Exness?

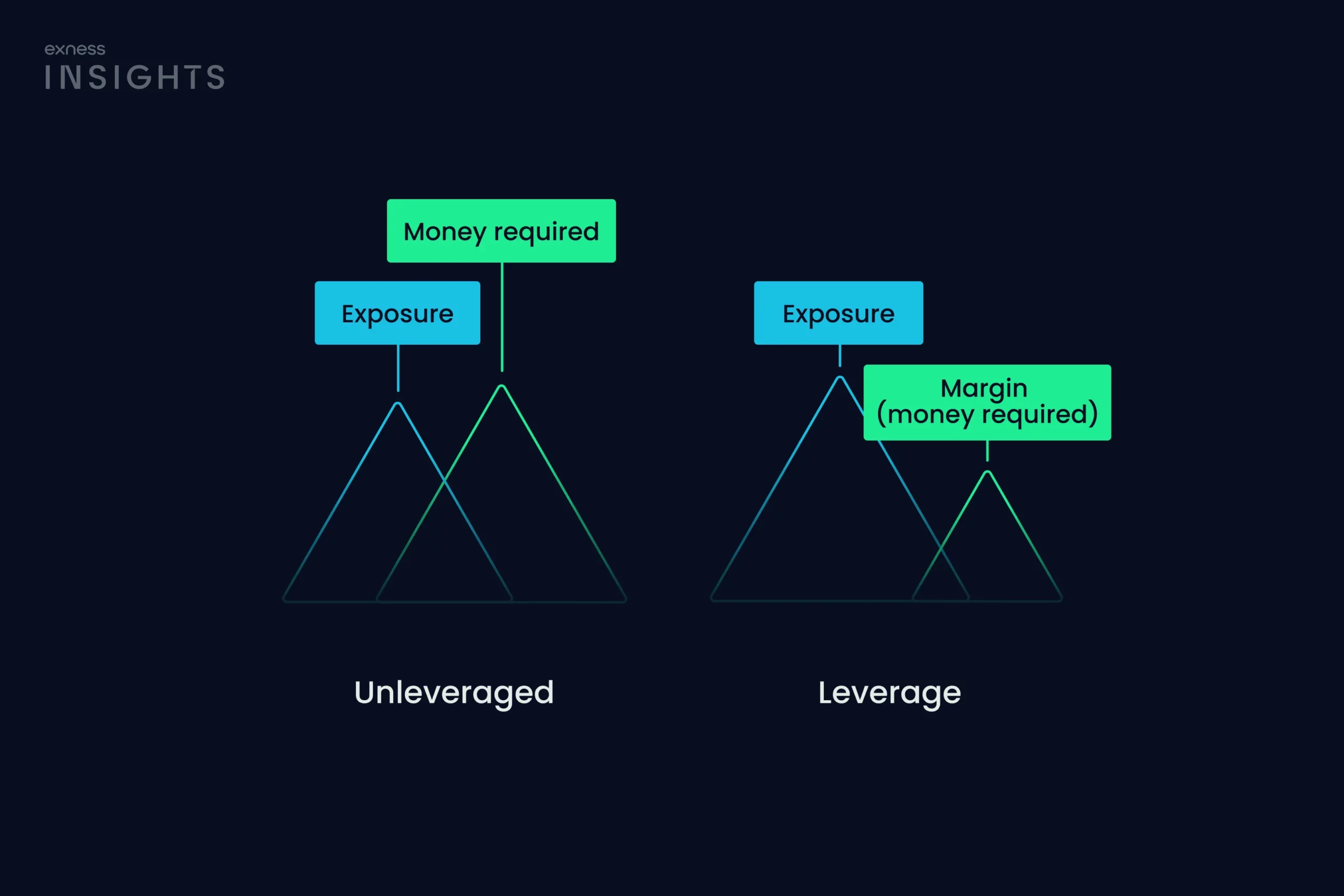

This means that there’s no limit to how much leverage you can use on Exness. In normal trading, brokers will allow a maximum leverage ratio, e.g. 1:100 or 1:200. You don’t face these restrictions with unlimited leverage. You can leverage a lot more capital with a significantly smaller amount resting in your account.

The feature is primarily geared toward more experienced traders. It lets you trade larger and with smaller deposits. But ability to trade big doesn’t mean it’s a good thing to do. The greater the leverage, the greater the risk, and know that before you dive in.

Risks of Using High Leverage on Exness

Using high leverage can be risky. When you trade with leverage, your potential profit is bigger, but so is your potential loss. The biggest risk with unlimited leverage is that a small move in the market can result in significant losses. Even if the market moves just a little in the wrong direction, it can wipe out your account.

- Margin Calls: With unlimited leverage, your margin requirements are low. But if the market turns against you, you could quickly face a margin call. This means you’ll need to deposit more money to keep your trade open, or your position will be closed.

- Greater Losses: Because your position is larger, the losses will be greater. This can lead to bigger losses than you initially planned.

- Stress and Pressure: Trading with high leverage can also be stressful. You may feel the need to monitor your trades more closely and make quick decisions. This pressure can lead to mistakes or emotional trading.

The bottom line is that unlimited leverage can be powerful, but it’s not something to take lightly. You need to be prepared for the risks and have a solid strategy in place.

Strategies for Trading with High Leverage on Exness

When you trade with high leverage on Exness, it’s important to have a strategy in place. High leverage lets you control larger positions, but it also means bigger risks. Here are a few strategies to help you trade smartly:

- Start Small: Even though you have the option to use high leverage, it’s a good idea to start with smaller trades. This way, you can get used to the risks and understand how leverage affects your profits and losses.

- Use Technical Analysis: Before entering a trade, take a good look at the charts. Indicators like moving averages or RSI can help you spot trends and decide the best time to buy or sell.

- Have a Plan: Know your entry and exit points before you open a position. Set stop-loss orders to protect yourself from big losses. A plan helps you stay calm, even when the market moves quickly.

- Stick to Liquid Assets: Focus on highly liquid markets, like major currency pairs. These markets are less volatile, making it easier to manage your trades with high leverage.

High leverage can be tempting, but without a solid strategy, it can quickly turn risky. Always be prepared and trade wisely.

Risk Management When Using High Leverage on Exness

High leverage needs risk management but is not the only one. Although leverage can help you increase your earnings, it can also magnify your losses. For one controlling a risk is the effective use of stop-loss orders. These orders will automatically close your trade when the price goes against you, which means you’ll never lose more money than you want to risk.

The take profit order is another significant tool. This order cancels your trade when the price hits your target, effectively locking in your profits. Avoid using the maximum leverage all the time as well. It can be a good tweak, especially for an uncertain market, to go a little lower on your leverage to reduce risk.

You can also reduce risk by spreading your trades across different positions. This is called diversification. It helps protect your account in case one trade doesn’t go as planned. Finally, keep track of the latest news that could affect the market. Events like economic reports or political changes can cause large price movements, so staying informed is important.

Examples of Trading with Maximum Leverage on Exness

Let’s look at some examples to understand how trading with high leverage works in practice:

Example 1: Forex Trade with 1:100 Leverage

Imagine you have $1,000 in your account and decide to trade EUR/USD with a 1:100 leverage. This means you control a $100,000 position. If the market moves 1% in your favor, you’ll make a $1,000 profit, doubling your account. But if it moves 1% against you, you’ll lose your entire $1,000.

Example 2: Trading with 1:500 Leverage on an Index

Now, let’s say you trade the S&P 500 with a 1:500 leverage. You have $2,000 in your account, which lets you control a $1,000,000 position. If the price moves in your favor by 0.5%, you make a $5,000 profit. But if the price drops 0.5%, you’ll lose the full $2,000 in your account.

Example 3: Commodities with Maximum Leverage

Let’s say you want to trade gold with 1:1000 leverage. With $500 in your account, you control a $500,000 position. If the price of gold moves in your favor by 0.2%, you’ll make a $1,000 profit. However, if it moves the other way, you risk losing your entire $500.

These examples show both the potential rewards and the risks of using maximum leverage. It’s easy to see how small market movements can have a big impact on your profits or losses. Always trade with caution and make sure you’re using proper risk management techniques.

Frequently Asked Questions (FAQ)

What does unlimited leverage mean on Exness?

With unlimited leverage on Exness, you can control larger trades with a smaller amount of money. Instead, there’s no maximum limit, as there is traditional leverage where there’s a specified ratio (example 1:100). This allows you to place larger trades, but increases the risk as well.

How do I enable unlimited leverage on my Exness account?

To enable unlimited leverage, you need to open an account that supports it. Once your account is set up, you can check the settings or contact Exness support to make sure unlimited leverage is activated. This option is usually available to more experienced traders.

Which instruments are eligible for unlimited leverage on Exness?

Popular instruments such as major currency pairs, metals (gold and silver), and certain indices provide unlimited leverage. These markets are the most liquid, so they are more stable and widely traded. Leverage limits may vary for other instruments.

What are the risks of unlimited leverage on Exness?

Potential activation of unlimited leverage results in greater losses and becomes the biggest menace. The good news is that you can make huge profits, but even a small movement in the market in the opposite direction can result in huge losses. Tools such as stop-loss orders are necessary in order to protect your account from these risks.

Can beginners use unlimited leverage on Exness?

Unlimited leverage can technically be used by beginners, but it is not advisable. There’s a lot at stake, and novices may lack the experience to navigate them. You should start at a lower leverage until comfortable with trading and risk management.

You may also be interested in: