Is Crypto Options Trading Available on Exness?

Looking to dive into crypto options trading on Exness? As someone who’s been trading digital assets since 2017, I’ve explored all the offerings on major platforms. Currently, Exness focuses on cryptocurrency CFDs rather than options contracts. Let me walk you through what’s actually available and what alternatives you might consider if you’re looking for more advanced crypto trading instruments.

Analysis of Available Cryptocurrency Instruments on Exness

Exness currently offers cryptocurrency CFDs (Contracts for Difference) rather than options. As of March 2025, you can trade several major cryptocurrencies including Bitcoin, Ethereum, Litecoin, and Ripple against USD and other currencies. The platform features competitive spreads that typically range from 0.8% to 2% depending on market conditions.

I’ve been trading crypto CFDs on Exness for about two years now. What I particularly appreciate is the ability to go both long and short on these instruments. This flexibility has proven invaluable during volatile market conditions. For instance, during last December’s market correction, I was able to capitalize on downward price movements by opening short positions on BTC/USD.

The leverage available for crypto trading on Exness is capped at 1:20 for most accounts, which is generous compared to many competitors but still keeps risk at manageable levels. Keep in mind that weekend trading can sometimes see wider spreads due to lower market liquidity.

Comparison of Spot Trading vs. Crypto Options

Spot trading and options trading represent two fundamentally different approaches to the crypto market. Here’s how they stack up:

Spot trading is straightforward – you’re buying the actual asset (or in the case of Exness, a CFD that tracks the asset’s price). When I started trading on Exness, I stuck to spot trading because of its simplicity. You profit when prices go up if you’re long, or when prices fall if you’re short.

Options trading, on the other hand, is a derivatives strategy that gives you the right (but not obligation) to buy or sell an asset at a predetermined price. I first explored options trading on another platform after about a year of spot trading experience.

The main differences I’ve found are:

- Risk profile: With spot trading, your maximum loss is your investment (or more with leverage). Options limit your downside to the premium paid.

- Strategy complexity: Spot is much simpler. Options require understanding concepts like strike prices, premiums, expiration dates, and the Greeks.

- Profit potential: Options can offer much higher percentage returns on investment for the same price movement.

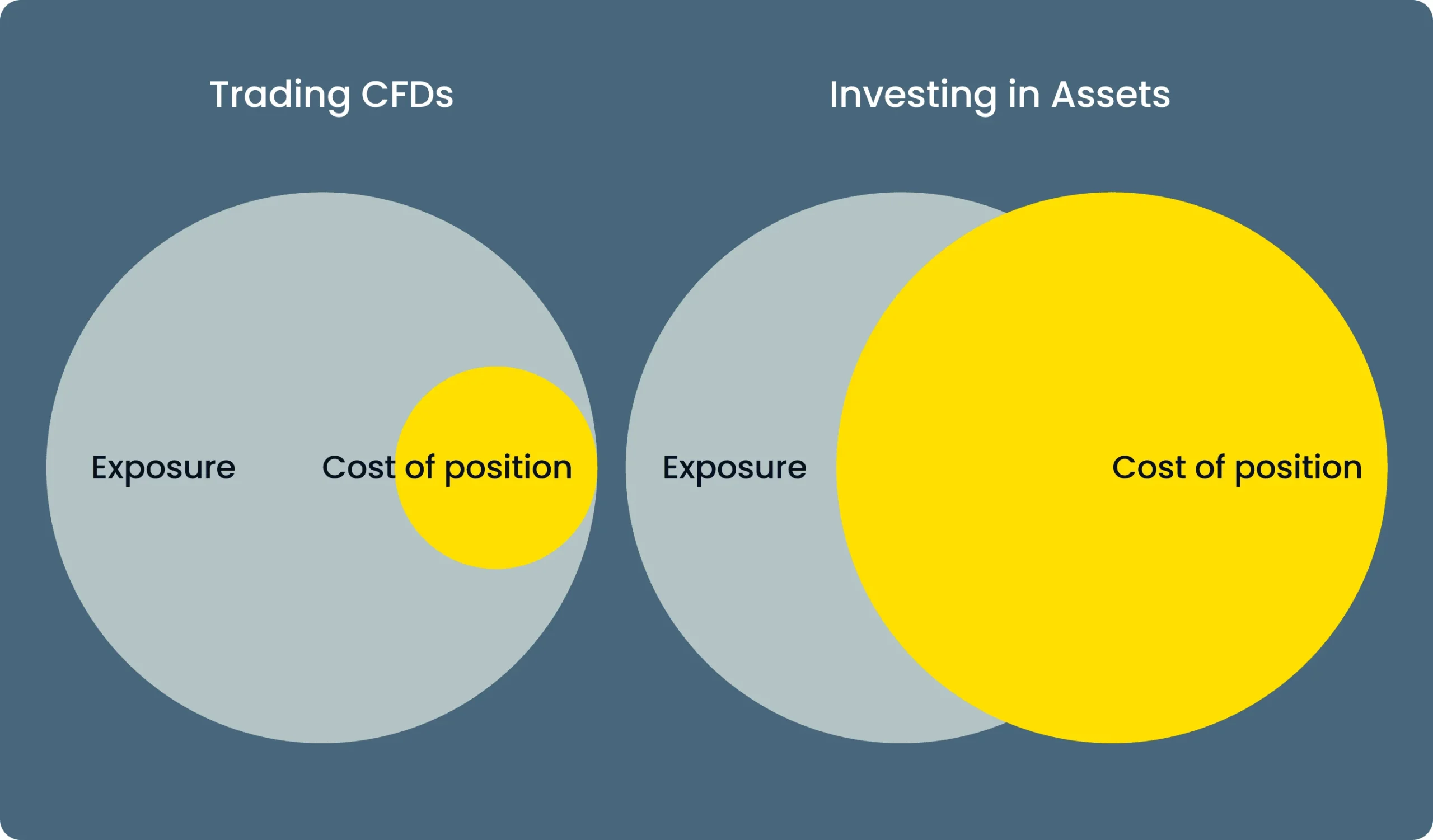

- Capital efficiency: Options typically require less capital for similar exposure.

While Exness excels in spot CFD trading, traders looking for options strategies will need to look elsewhere for now.

Potential Benefits of Cryptocurrency Options

If Exness were to introduce crypto options, traders would gain several advantages:

- Limited downside risk – When buying options, your maximum loss is capped at the premium paid

- Enhanced leverage – Options provide significant leverage without the liquidation risks of margin trading

- Strategic versatility – You can profit from sideways markets using strategies like iron condors or straddles

- Portfolio hedging – Options serve as excellent hedging tools against existing crypto positions

- Lower capital requirements – Control larger positions with smaller upfront investment

- Volatility exploitation – Directly capitalize on expected market volatility, not just price direction

I’ve personally used options on other platforms to hedge my spot positions during uncertain market conditions. For example, during the ETF approval rumors last year, I purchased put options as insurance against my long Bitcoin holdings – a strategy that proved valuable when the market briefly tumbled on delayed announcements.

Alternative Ways to Trade Crypto Assets on Exness

While options aren’t currently available, Exness does offer several alternatives for crypto exposure:

Cryptocurrency CFDs remain the primary method for trading digital assets on Exness. These instruments allow you to speculate on price movements without owning the underlying coins. I typically use these for short-term positions lasting from a few hours to several days.

Leveraged trading is available with up to 1:20 multiplication, though I personally prefer to keep my leverage below 1:5 to manage risk effectively. Remember that while leverage can amplify profits, it also magnifies losses.

Another approach I’ve found useful is trading crypto-fiat pairs like BTC/USD alongside crypto-crypto pairs like ETH/BTC. This combination lets you capitalize on relative strength movements between different digital assets.

For those seeking diversification, Exness also offers cryptocurrency indices that track baskets of digital assets. I’ve occasionally used these to gain broader market exposure without having to manage multiple individual positions.

Expectations for the Launch of Crypto Options on Exness

Based on market trends and platform development patterns, there’s reason to believe Exness might eventually add crypto options trading. Major competitors have been expanding their derivatives offerings, and customer demand for more sophisticated trading instruments continues to grow.

My industry contacts suggest that regulatory clarity is often the primary hurdle for brokers considering options products. As the regulatory landscape matures, the likelihood of seeing crypto options on platforms like Exness increases.

If implementation follows patterns I’ve observed with other brokers, Exness would likely start with Bitcoin and Ethereum options before expanding to other cryptocurrencies. Initial offerings would probably focus on American-style options with standardized expiration dates.

From my experience watching platform expansions, I estimate we could see crypto options on Exness within the next 6-18 months, though this is speculative. The company has generally been responsive to user demands and market trends.

Frequently Asked Questions (FAQ)

Does Exness currently offer crypto options trading?

No, Exness doesn’t currently offer cryptocurrency options trading as they focus exclusively on crypto CFDs rather than options contracts, so while you can trade price movements of major cryptocurrencies, you won’t find options strategies like calls and puts on the platform, meaning you’ll need to use a specialized derivatives exchange if you’re specifically looking for crypto options.

What cryptocurrency instruments are available on Exness?

Exness provides CFDs on major cryptocurrencies including Bitcoin, Ethereum, Litecoin, Ripple and several others tradable against USD and select fiat currencies, with their range covering most top 10 cryptocurrencies by market cap, offering 24/7 trading with leverage up to 1:20, though specific offerings may vary based on your account type and regional regulations.

How does spot trading differ from crypto options?

Spot trading involves buying or selling assets at current market prices for immediate settlement (or with CFDs, speculating on price movements without ownership), while options give you the right but not obligation to buy or sell at a predetermined price before expiration, making spot trading more straightforward but less strategically flexible, whereas options allow for complex strategies that can profit even in sideways markets and provide defined risk when purchasing contracts, though they have time decay working against long positions.

What are the advantages of trading cryptocurrency options?

Trading cryptocurrency options provides exceptional risk management with limited maximum loss when buying (just the premium paid), leverage without liquidation risk unlike margin trading, strategic flexibility to profit in bullish, bearish or sideways markets using different combinations, effective portfolio hedging capabilities during uncertain conditions, and the ability to directly trade volatility expectations rather than just price direction, which proves particularly valuable in crypto markets where volatility can spike dramatically around major news events.

Can I trade leveraged crypto derivatives on Exness?

Yes, you can trade leveraged crypto derivatives on Exness through their CFD offerings with leverage up to 1:20 on cryptocurrency CFDs (meaning $1,000 could potentially control positions worth up to $20,000), though experienced traders typically use lower leverage ratios of 1:2 to 1:5 for more effective risk management, with Exness providing essential negative balance protection to prevent losses exceeding your account balance, while remembering that higher leverage equally magnifies both profits and losses.

You may also be interested in: