Strategies for Profitable Trading on Exness

To make profits from trading on Exness you will need a good plan. This involves studying the platform, using proper tools and risk management. Learning, and having a strategy is ultra-important here whether you are brand new or experienced in trading. In this post, I am going to take you through the essential buttresses that should help in making your way around these platforms as well formulate a strategy.

Understanding the Exness Platform

It is suitable for beginners that Exness offers a very convenient platform It comes with many features which assist traders in making sound decisions. And the first key to successful trading is learning how to use these features.

MetaTrader 4 vs. MetaTrader 5 on Exness

When you start trading with Exness, you’ll need to choose between MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms are popular, but they have some differences.

| Feature | MetaTrader 4 (MT4) | MetaTrader 5 (MT5) |

| Release Year | 2005 | 2010 |

| Number of Built-in Indicators | 30 | 38 |

| Chart Timeframes | 9 | 21 |

| Order Execution Types | 2 (Instant and Market) | 4 (Instant, Market, Pending, and Stop) |

| Pending Order Types | 4 (Buy Limit, Sell Limit, Buy Stop, Sell Stop) | 6 (Buy Limit, Sell Limit, Buy Stop, Sell Stop, Buy Stop Limit, Sell Stop Limit) |

| Number of Trading Instruments | 200+ | 400+ |

| Depth of Market (DOM) | Not Available | Available |

| Automated Trading (EAs) | Yes | Yes |

| Economic Calendar | No | Yes |

| Hedging | Supported | Supported |

| Market Execution Speed | Milliseconds (depending on server) | Milliseconds (depending on server) |

| Platform Accessibility | Desktop, Mobile, Web | Desktop, Mobile, Web |

| Supported Asset Classes | Forex, Metals, Cryptocurrencies, Indices, Energies | Forex, Metals, Cryptocurrencies, Indices, Energies, Stocks, Commodities |

Exness WebTrader

If you don’t want to download any software, Exness also offers a WebTrader. This platform works directly from your web browser. It’s convenient if you need to trade from different devices or locations.

Exness WebTrader is user-friendly and offers many of the same features as MT4 and MT5. You get advanced charting tools and real-time price updates, all without needing to install anything. It’s great for quick access and allows you to trade with just one click. Plus, it’s secure and works on all major browsers.

To sum up, Exness gives you different options to trade, whether you prefer a downloadable platform like MT4 or MT5, or a web-based option like WebTrader. Understanding these tools will help you choose the one that fits your trading style best.

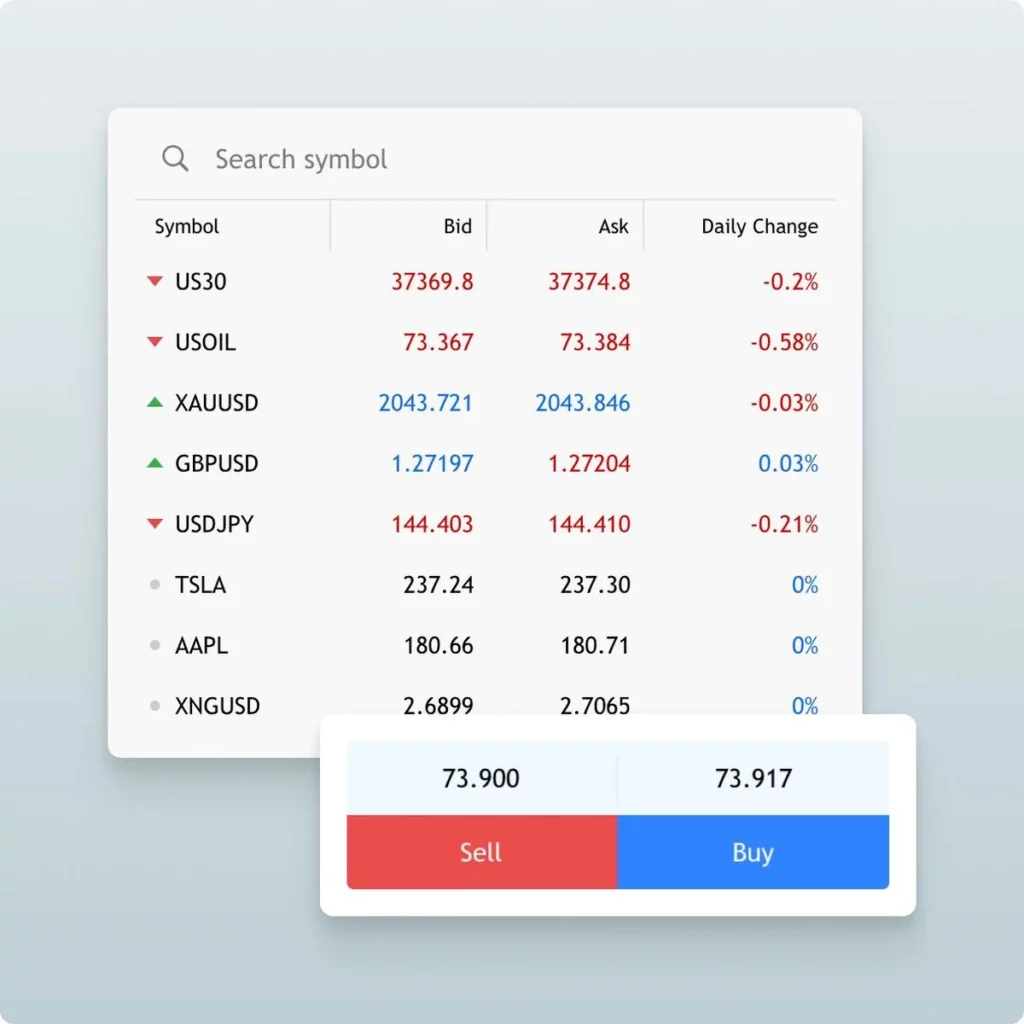

Exness Trading Instruments

Exness provides a range of trading instruments that suit different trading preferences. Here’s what you can trade:

- Forex: Trade over 100 currency pairs, including popular ones like EUR/USD and GBP/USD. Exness offers tight spreads and quick execution.

- Cryptocurrencies: Trade well-known digital currencies like Bitcoin and Ethereum. These can be very volatile, offering chances for high returns.

- Metals: Invest in gold and silver, which are often considered safe assets, especially during uncertain times.

- Stocks and Indices: Trade shares of big companies like Apple and Tesla or speculate on major stock indices like the S&P 500.

- Energies: Trade commodities like crude oil and natural gas, which are often affected by global events.

Fundamental Analysis Techniques

Fundamental analysis helps you understand what drives the markets by looking at key economic factors. Here’s how you can use it:

- Economic Indicators: Watch for reports on GDP, unemployment, and inflation. For example, strong GDP growth might strengthen a country’s currency, while high inflation might weaken it.

- Corporate Earnings: If you trade stocks, pay attention to company earnings reports. Positive earnings often push stock prices up, while negative earnings can cause them to drop.

- Geopolitical Events: Events like elections, trade disputes, and natural disasters can impact the markets. For example, political instability in an oil-producing country might drive up oil prices.

- Monetary Policy: Central banks influence markets by setting interest rates. Changes in these rates can affect everything from currency values to stock prices.

Technical Analysis for Equity Traders

Technical analysis is a technique used by traders to study the movement of stock prices. Rather than analyze a company’s financials, this relies on looking at charts and patterns in the market. Traders can do this by analyzing these patterns to forecast where stock prices may head next. Making trading decisions is more educated and strategic, so they can decide when buy or sell.

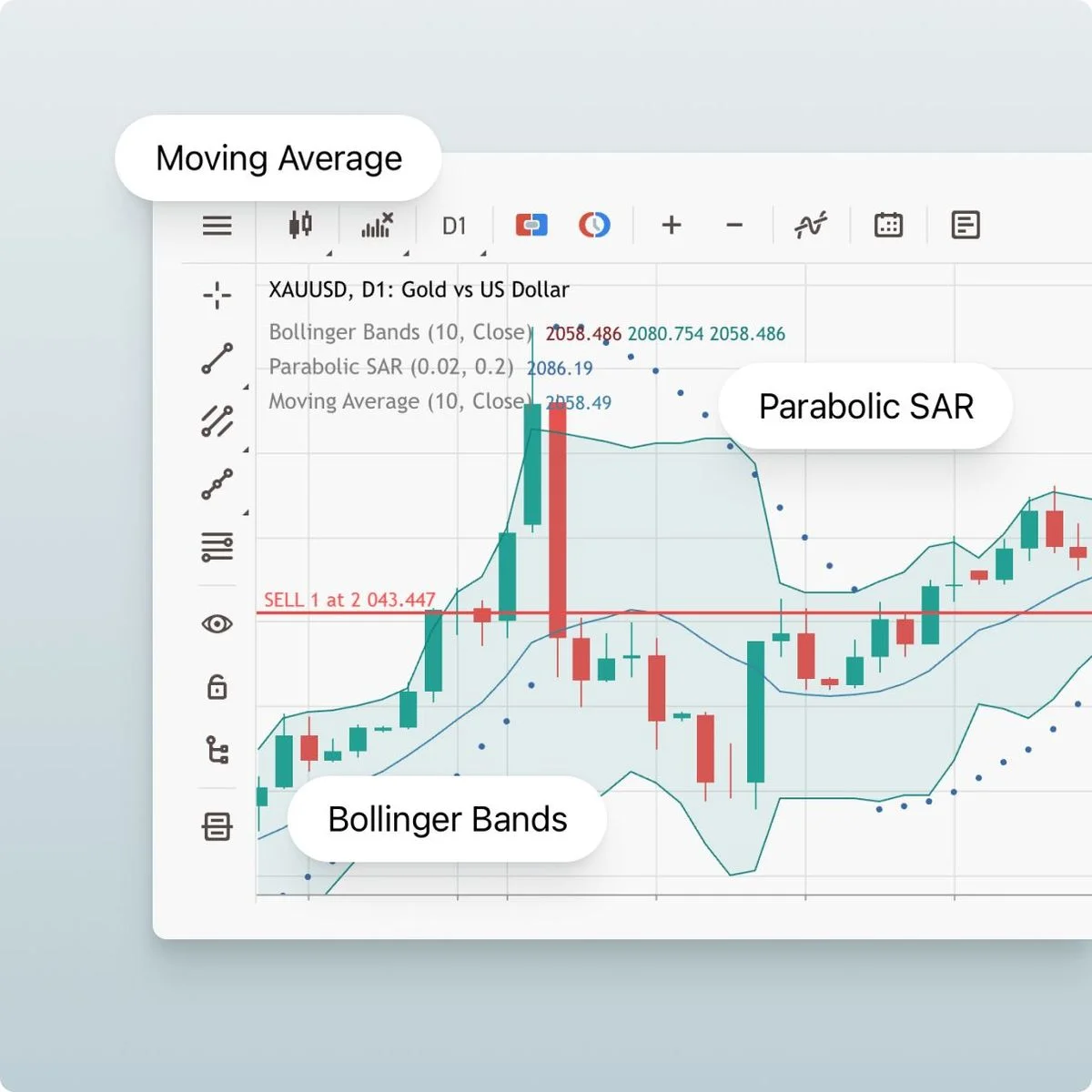

Popular Indicators on Exness Charts

Exness offers several helpful tools, called indicators, that traders use to analyze the market. Here are some of the most popular ones:

- Moving Averages (MA): These lines show the average price of a stock over a certain period, helping you see the overall trend, whether it’s going up or down.

- Relative Strength Index (RSI): This indicator measures how fast a stock’s price is moving. It helps you spot when a stock might be too high (overbought) or too low (oversold), which could signal a price change.

- Bollinger Bands: These bands show the range of a stock’s price movement. When the price reaches the upper or lower band, it might mean the stock is about to reverse direction.

- MACD (Moving Average Convergence Divergence): This tool helps identify changes in a stock’s trend. It shows when the short-term price trend is about to cross the long-term trend, indicating a possible buy or sell signal.

- Stochastic Oscillator: This indicator compares a stock’s current price to its range over a recent period. It’s useful for finding out if a stock might be overbought or oversold.

Fibonacci Retracements in Currency Pairs

Fibonacci retracement is a tool that traders use to find potential turning points in the market, especially in forex trading. It helps identify where the price of a currency pair might reverse after moving in a particular direction.

To use Fibonacci retracements, you select two key price points, like a recent high and low, and the tool will show you important levels between these points. These levels, such as 23.6%, 38.2%, 50%, and 61.8%, are potential areas where the price might pause or reverse.

For example, if a currency pair rises from 1.1000 to 1.2000, you can use Fibonacci retracement to see if the price might pull back to around 1.1500 (50%) or 1.1380 (61.8%) before continuing its trend. These levels help traders spot potential entry or exit points.

Risk Management on Exness

Managing risk is crucial for successful trading, and Exness offers tools to help you do it effectively. Here’s how you can manage risk on the Exness platform:

1. Use Stop Loss and Take Profit Orders:

Stop loss orders automatically close a trade if the market moves against you, limiting your losses. Take profit orders close a trade when it reaches a certain profit, locking in your gains. These orders help you control how much you lose or gain on a trade.

3. Be Cautious with Leverage:

Leverage lets you trade with more money than you have in your account, but it also increases risk. While leverage can boost your profits, it can also lead to bigger losses. Start with lower leverage if you’re new to trading, and only increase it as you gain experience.

5. Regularly Review Your Strategy:

Markets change, so it’s important to regularly check and update your trading strategy. Exness provides tools to help you monitor market trends and adjust your approach as needed.

2. Choose the Right Trade Size:

It’s important to decide how much money to risk on each trade. A good rule is to risk only 1-2% of your account on a single trade. Exness allows you to easily adjust your trade size to match your risk level, helping you avoid big losses.

4. Diversify Your Trades:

Don’t put all your money into one trade. Spread your investments across different markets like forex, stocks, and commodities. This way, a loss in one trade won’t wipe out your entire account. Exness offers a variety of assets, making it easy to diversify.

6. Stay Informed:

Keep up with the latest market news and events, as they can affect your trades. Exness offers news feeds and market analysis to help you stay updated and make better trading decisions.

Profitable Equity Trading Strategies

To succeed in trading stocks, it’s important to use strategies that fit your style and the market. Here are some common strategies that traders on Exness use to make profits.

Trend-Following vs Mean Reversion

Trend-Following is about trading in the direction the market is moving. If a stock is rising, trend-following traders will buy, expecting it to continue going up. If it’s falling, they might sell or short the stock. This strategy works well in markets where prices are clearly moving in one direction. Tools like moving averages help identify these trends.

Mean Reversion is based on the idea that prices will eventually return to their average. If a stock’s price goes up too much or drops too low, mean reversion traders expect it to move back to its normal level. This strategy is useful in stable markets where prices move within a range. Indicators like Bollinger Bands and RSI help spot these opportunities.

Both strategies are useful, but they work best in different market conditions. Trend-following is great for strong trends, while mean reversion is better for steady, range-bound markets.

Scalping on Exness Standard Accounts

Scalping is a strategy where traders make many quick trades to earn small profits from tiny price changes. Scalpers hold trades for just a few minutes or even seconds and make multiple trades throughout the day. The goal is to accumulate small gains that add up over time.

Exness Standard Accounts are popular for scalping because they offer low spreads and fast execution, which are essential for this strategy. Traders use tools like moving averages and support and resistance levels to make quick decisions and enter and exit trades rapidly. Scalping requires focus and quick thinking to be successful.

Exness Welcome Bonus for New Traders

Exness offers a Welcome Bonus to new traders, giving you extra money when you open an account and make your first deposit. This bonus can help you start trading with more funds, allowing you to try different strategies without risking too much of your own money.

However, be sure to read the terms and conditions, as there may be rules about how you can use the bonus and when you can withdraw it. The Welcome Bonus is a great way for new traders to get started and explore the markets with less financial pressure.

Options for Copying Deals and Social Trading

Exness makes it easy to participate in social trading, where you can copy the trades of experienced traders. This is great for beginners or anyone who wants to follow successful traders.

1. Social Trading Platform:

Exness offers a platform where you can follow top traders and automatically copy their trades. You can see how well they’ve done in the past and choose who you want to follow. This lets you benefit from their expertise without needing to make all the decisions yourself.

3. Becoming a Strategy Provider:

If you’re a skilled trader, you can become a strategy provider on Exness. Others can copy your trades, and you earn extra money based on how well you perform and how many people follow you. It’s a way to share your trading knowledge and profit from it.

2. Copy Trading:

With copy trading, you select a trader to follow, and their trades are copied directly into your account. This is a good option if you want to trade but don’t have the time or experience to manage your trades.

4. Customization and Control:

Exness lets you control how much money you want to invest in copying trades. You can set limits and manage your risk, so you stay in control of your investments.

5. Transparency and Performance Tracking:

Exness provides clear information about the traders you follow, including their past performance and success rates. This helps you make smart decisions about who to follow and how to manage your money.

You may also be interested in: