Does Exness Offer a Micro Account?

Looking for a way to start trading with minimal capital? You’re not alone. Many traders want to test the waters without risking substantial funds. Exness is a popular broker known for its flexible trading conditions, but do they offer a designated micro account option for those with limited trading budgets?

Quick Answer

No, Exness doesn’t offer a specific “Micro Account” by that name. However, don’t worry. Exness provides several accounts with low minimum deposits that serve the same purpose.

Their Standard account lets you start with just $1. That’s right – one dollar. This is perfect for small budgets. You can trade micro-lots (0.01 lot size) on many instruments with this account.

There’s no commission on trades. Exness makes money through the spread instead. This makes it easier to understand your costs when you’re just starting out.

Think of it as a micro account without the label. The low entry point gives beginners a chance to learn without risking much money. I’ve seen many new traders start this way and gradually build up their experience and capital.

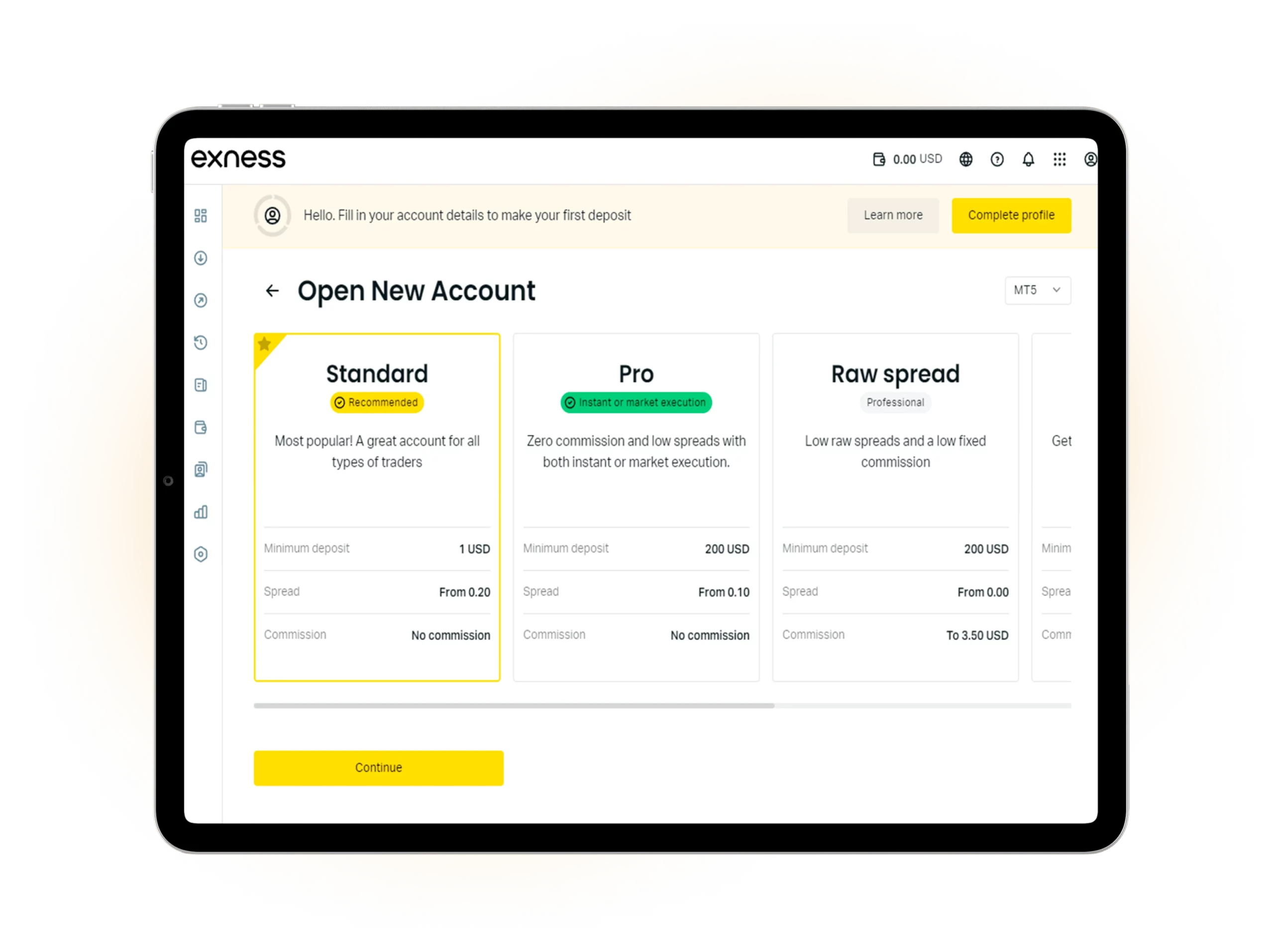

Available Exness Account Types

Exness offers several account types to choose from. Each one has different features.

| Account Type | Min Deposit | Commission | Spreads | Max Leverage | Best For |

| Standard | $1 | None | From 0.3 pips | Up to 1:2000 | Beginners |

| Raw Spread | $200 | $3.5 per lot | From 0 pips | Up to 1:2000 | Active traders |

| Zero | $200 | $3.5 per lot | Zero | Up to 1:2000 | Scalpers |

| Pro | $500 | None | Tighter than Standard | Up to 1:2000 | High-volume traders |

All accounts work with MT4 and MT5 platforms. You can trade forex, stocks, indices, metals, energies, and crypto.

Best Alternatives for Small-Budget Trading on Exness

Not everyone has a big budget for trading, and that’s okay. Exness offers several options for traders who want to start with a small amount of money.

Standard Cent Account – The Best Choice for Small Budgets

This account is perfect for beginners or low-budget traders. It allows you to trade in cent lots, which means you can trade with just a few dollars. Even if you deposit $10, it appears as 1,000 cents in your account. This helps you manage risks better while still experiencing real trading conditions.

Standard Account – No Minimum Deposit

If you want to trade with a little more flexibility, the Standard Account is a great option. It has no fixed minimum deposit, meaning you can start with whatever amount you’re comfortable with. The spreads are low, and there are no extra commissions.

Using Leverage to Trade with Small Deposits

One of the best things about Exness is high leverage. Depending on your country, you may be able to use 1:Unlimited leverage. This means that even a small deposit can control larger positions. But remember, leverage can increase both profits and losses, so use it wisely.

Start with a Demo Account

Not sure if you’re ready to risk real money? Try a demo account first. Exness offers free demo accounts where you can practice trading in real market conditions. It’s a great way to build confidence before depositing real money.

How to Start Trading with Small Capital on Exness

Getting started with small money on Exness is easy. I’ve done it myself. First, go to the Exness website and click “Open Account.” Fill in your details and verify who you are. This takes about 10 minutes. Pick the Standard Account because it only needs $1 to start. Next, add money to your account. I suggest putting in at least $10-50 even though $1 is the minimum. This gives you some room to make mistakes. You can use bank cards or e-wallets like Skrill. The money usually shows up right away.

Download MT4 or MT5 trading platform. I like MT5 better, but both work fine. Log in with the details Exness emails you. Take some time to learn how the platform works before you risk real money. Only use micro-lots (0.01) at first. This is super important! With a small deposit, bigger positions could wipe out your account fast. I lost my first deposit by ignoring this advice. A micro-lot on EUR/USD moves your balance about 10 cents per pip.

Here’s a quick list of steps to start:

- Create an Exness account

- Choose Standard Account type

- Verify your identity

- Deposit at least $10 (though $1 is minimum)

- Download MT4/MT5 platform

- Start with micro-lots only

- Focus on 1-2 currency pairs

6 Asset Classes – 16 Trading Platforms – Over 1000 Instruments.

Trade Forex, Individual Stocks, Commodities, Precious Metals, Energies and Equity Indices at Exness.

Common Questions About Small Deposit Trading

What is the minimum amount to start trading with Exness?

There is no fixed minimum deposit for Standard Cent and Standard Accounts, but some payment methods allow $1, while others need $10 or more. Pro, Raw Spread, and Zero Accounts require $200.

How can I trade effectively with a small deposit?

Use a Standard Cent Account to trade smaller amounts with lower risk. Choose low-spread pairs like EUR/USD, set a stop-loss, and start with low leverage (1:100 or 1:200). Avoid too many trades at once and focus on smart risk management.

Which Exness account is best for beginners?

The Standard Cent Account is best for beginners because it allows small trades, no fixed deposit, and high leverage. If you want to trade larger amounts later, you can switch to a Standard Account.

Can I switch account types later?

Yes. You can open multiple accounts in your Personal Area and switch anytime. Start with a Standard Cent Account and later move to Standard, Pro, or Raw Spread Accounts as you gain experience.

What leverage options are available for small deposits?

Exness offers up to 1:Unlimited leverage, but beginners should use 1:100 or 1:200 to manage risk. The available leverage depends on your account type, country, and experience level.

You may also be interested in:

6 Asset Classes – 16 Trading Platforms – Over 1000 Instruments.